With Japanese companies across the board expanding their budgets for R&D, the Land of the Rising Sun is ready to rise again, developing products for an ever-changing world.

In a bid to position itself at the forefront of innovation once again and to ward off competition from regional rivals like South Korea and China, Japan is boosting investment in R&D across the board, from the nation’s biggest conglomerates like Toyota, Honda, Panasonic and Sony, to smaller, lesser known B2B firms in specialized industries.

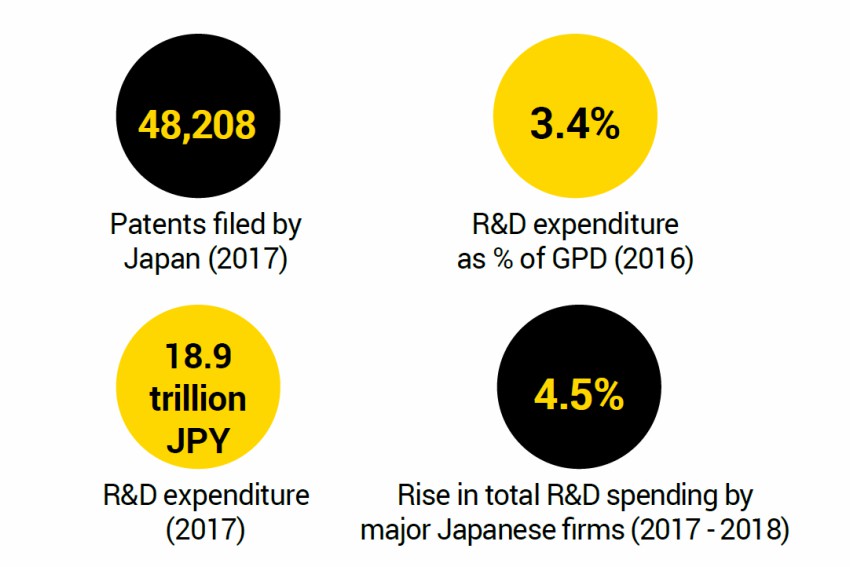

A survey released earlier this year by Nikkei about R&D activities for fiscal 2018, which started in April, concludes that total R&D spending by major Japanese companies is set to rise 4.5 percent on the previous year, which will be the ninth consecutive year of growth. These Japanese companies are aggressively investing in innovative technologies, ranging from AI and robotics, to biotech, compound materials and chemicals – technologies which they see as key to future competiveness.

One such company that has been boosting spending on R&D and innovation is DIC Corporation, a world-leading manufacturer of printing inks and organic pigments, which in recent years has diversified into fine chemicals, polymers, compounds and application materials.

In October, DIC announced that it had commenced full-scale R&D of compounds used as materials for stereolithography 3D printing, leveraging on its distinctive polymer designing and compounding technologies. In addition to conducting R&D in Japan, DIC has established a dedicated research department on the site of the Fine Chemicals Technical Center Korea, and in August invested in a Japanese biotech firm, as it looks to strengthen its foothold in biotechnologies.

A Japanese company with a top global share in printing inks and organic pigments, DIC celebrated its 110th anniversary this year, and has established a broad portfolio in an array of sectors spanning more than 60 countries worldwide. You could say it’s been a colorful past century or so; one that has been characterized by continual innovation to provide products that respond to the changing needs and tastes of society.

With such a vibrant history behind it, it could have easily been a temptation for DIC Corporation to dwell on previous successes in the ink business. However, the company’s philosophy has never been to look back, but look forward, says President and CEO, Kaoru Ino.

“Our management vision is the same as our brand slogan: to advance through constant innovation,” he explains. “This is a unique vision within our industry, and that uniqueness is created through the maintenance of the DIC spirit.”

Perhaps a perfect encapsulation of this fierce commitment to reinvention was the group’s move to rename the business in 2008, coinciding with its centenary celebrations. For many businesses lucky enough to reach such a significant milestone, the occasion would inevitably be greeted with over-sentimentality. Not for this company. Rebranding itself from Dainippon Ink & Chemicals to DIC Corporation was all about moving with the times.

“Since we were already well known in the market, we no longer wanted our customers to identify us as a manufacturer limited to the ink production, so we changed our name,” says Mr. Ino. Indeed, with DIC Corporation’s core market of traditional printing inks having seen a marked reduction in demand, the company’s decision to broaden its palette, commercially speaking, was a purely strategic one.

Mr. Ino explains: “Throughout the years, we have evolved and diversified our business to adapt to new necessities. As a result, we are now offering a variety of products.”

And this diversification process has not just been limited to product areas, but new industries too, with the group today cementing a major presence in international sectors including automobiles, electronics, foods and housing. It is within these markets that “the commercialization of natural colors” has become a unique purpose for the company.

With DIC Corporation now advancing into the digital era, it is adapting its portfolio further still to offer solutions for monitors and displays, whilst at the same time closely monitoring the newest trends of the market in order to provide the colors required by its clients across its product range.

Japan Inc. may be investing more in R&D to ward off competition from China and South Korea, but there is one thing that has always given Japan its competitive edge – monozukuri. Monozukuri is the unique essence of Japanese manufacturing which revolves around a sincere dedication to craftsmanship, perfection and innovation.

“Japanese people have a unique mentality that upholds attention to detail and customer satisfaction above all else. This devotion to craftsmanship has made our products reliable and trustworthy,” says Hiromichi Tatsuno, President of the Tatsuno Corporation.

“Japanese society promotes honesty, diligence and unity. That unique mindset is exported abroad by Japanese corporations.”

Masahiro Nakajima, Chairman and CEO of Morita Holdings Corporation, agrees that the nation’s manufacturing prowess is also deeply rooted in the character of Japanese people. “Japanese people have a deep interest, not just in making things, but also in preserving them in a proper state and developing them at a higher level of quality. That is what distinguishes Japanese people as a nation,” he says.

For Naotaka Kondo, President of Toyo Tanso Co. Ltd. – whose main business is graphite, a type of carbon that is used in a range of industries, such as in the production of semiconductors – the underlying value of monozukuri is assessing the needs of society, taking time to think about future needs, and truly listening to the customer.

“We follow trends that are happening around us and propose what could be helpful or what could be necessary in the near future. This creates a win-win situation between us as a manufacturer and the customers that use and apply our products in their daily lives,” he says.

“Since our inception, we have embraced the pioneering spirit of manufacturing completely unique products, and continued to take on challenges in the pursuit of unique and innovative carbon products specialized for highly functional fields.”

Toyo Tanso was the first company in the world to successfully mass produce large-size isotropic graphite in 1974, and its carbon products and technology have continued to evolve with the needs of the times. Its products can be found in everything from automobiles and home appliances to cutting-edge products in fields such as aerospace and medical care. The company’s operations span the globe, and in the U.S. it has been servicing the semiconductor industry for over 25 years.

Toyo Tanso is also investing heavily in R&D to remain at the forefront of the graphite industry by providing innovative materials and solutions to help both the company and its customers to stay ahead of their competition. It has recently developed a diverse range of composite materials such as C/C carbon fibre, which is lighter and easier to handle than graphite.

“In the semiconductor industry, manufacturing equipment for semiconductors is becoming bigger in size to increase the volume of production. According to this trend, our graphite products, which are used in manufacturing equipment for semiconductors, are also getting heavier and bigger in size,” explains Mr. Kondo.

“Therefore, semiconductor customers are adopting lighter C/C composite products. Trends in size, upgrading equipment and lightweight requirements of equipment parts are not only seen in the semiconductor industry but also in other industries, so we are looking towards more expansion of this product.”

C/C is also being used in asteroid probes developed by the Japan Aerospace Exploration Agency and plasma testing equipment for nuclear fusion reactors.

Sumitomo Electric, a global leader in the manufacture of electric wire and optical fiber cables which is also developing photovoltaic solar panels for energy generation, is another company that has been dedicating more investment in R&D to stay ahead of the curve.

Last year, its R&D expenditure amounted to 117.7 billion yen ($ 1.04 billion). For this year, it has raised its R&D budget to 125 billion yen.

“This dedication to R&D allowed us to create new businesses, such as a concentrator photovoltaic (CPV) system that has twice the conversion efficiency of standard crystalline silicon photovoltaic,” says Osamu Inoue, president and COO.

“While developing new businesses is a crucial goal of our R&D, we also focus on enhancing the quality of our existing businesses. We are also developing advanced optical fiber products. We have developed ultra-high density optical fiber cable, and we are currently developing even more advanced products soon to be commercialized.”

As Japanese companies such as DIC, Toyo Tanso and Sumitomo continue to invest more in R&D to develop new products with the spirit of monozukuri, the Land of the Rising Sun is ready to rise again, putting itself at the forefront of innovation for a changing world.

0 COMMENTS