Sitting on the Guyana-Suriname Basin, ranked second in the world for untapped oil/gas potential, Guyana is poised for an energy revolution. CGX has been a mainstay of the sector for two decades, with Guyanese board-members and a Guyanese co-chairman. Prof. Suresh Narine, an award-winning scientist specializing in biomaterials and biofuels, outlines why exploiting Guyana’s rich natural resources is its most viable option to further its green trajectory

With a geological formation that mirrors basins in West Africa, Venezuela and Trinidad and Tobago, the Guyana-Suriname Basin, one of world’s newest oil frontiers, has gained significant international attention in recent years. Most of the industry’s biggest players are active in the underexploited oil play, including Shell, Exxon, Tullow, Petronas and Chevron, all of which are planning to drill more wells over the next three years.

As one of the longest standing operators, CGX Energy has the most extensive knowledge and experience of the basin. The Canadian company is solely focused on its operations in Guyana and has been active in the country for 15 years.

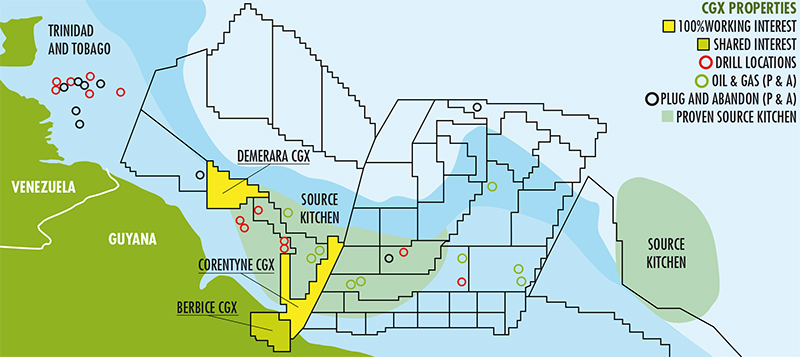

Holding 3.3 million acres across three blocks, Berbice (onshore), Demerara and Corentyne, it possesses the second-largest acreage in the basin and has invested more than all other E&P companies combined, or roughly 65% of the total capital expenditure in the basin.

“We are the only oil and gas company with significant expertise in the region. We are also the only oil and gas company with Guyanese board members and a Guyanese co-chairman. We have an in-country senior management team who are all Guyanese people. We are only focused on this basin,” explains Prof. Suresh Narine, the company’s co-chairman.

The Toronto-based firm has drilled more wells than any other company—six so far with plans to spud another next year. The Kabukalli well, named after a hardwood found in the Guyanese rainforest, will be drilled in the third quarter of 2015 and is estimated to hold close to 500 million barrels.

In order to deepen its investment in the basin, Pacific Rubiales, the largest independent producer of petroleum in Latin America, bought a controlling interest in CGX in 2013; Pacific Rubiales now has a 54% stake in CGX Energy. Pacific Rubiales’ technological capabilities (which has helped the company to have a geological success rate of 85%), coupled with CGX’s extensive local knowledge positions the latter to drastically increase its chances of commercial oil discovery going forward.

“The Pacific Rubiales partnership is a great enabler. They have one of the most modern geological data rooms in the world. They bring a critical mass of qualified, experienced and successful geologists to the table,” says Prof. Narine. “CGX, as a junior, lacked that sort of technical knowhow in the past. It lacked the sheer numbers and technical capacity that Pacific brings to the partnership. It brings the success rate and the ability to analyze and interpret data using the most modern methods available. The company boasts a geological success rate of eight and a half out of 10. We believe that the Guyana Basin should have a success rate of one in five or seven.”

CGX’s commitment to Guyana goes well beyond development of the basin. It supported Guyana in its territorial waters dispute with Suriname in 2007, by paying the government’s entire arbitration bill at the United Nation’s International Tribunal for Law of the Sea tribunal. “We decided to support this country at a time when Guyana didn’t have any way at all to finance this arbitration. We supported it because of our sense of patriotism and because of our sense of what is right. CGX has stood by Guyana in a very tangible and demonstrable sense.”

With a long history of social responsibility, CGX has invested more in education over the past four years than any other company operating in the extractive industries, according to the co-chairman. As a champion of local content, it employs 250 to 280 Guyanese when drilling aside from its all-Guyanese management team.

The company is also committed to the government’s green agenda. The Guyanese government is seeking to develop the country’s natural resources through environmentally friendly practices and active stakeholder management. CGX is emblematic of such practices as evidenced by its decision to cap its Jaguar-1 well due to environmental concerns.

“By exploiting natural resources in a responsible fashion – responsible here doesn’t only refer to the environment, it also refers to policy and good governance – Guyana can leapfrog to the state of the developed world by investing its proceeds from natural resource exploitation into sustainable industries,” says Prof. Narine.

0 COMMENTS