Founded in 1970, JESCO Holdings has had to diversify across various industries to deal with Japan’s changing landscape, but factors such as the quality of life, safety, and a strong economy have maintained its place as an attractive place to live.

One of the very big changes in recent years has been the depreciation of the JPY, reaching historical lows against the USD. A lot of experts are now saying this creates a very interesting time for Japan. On one hand, exports are cheaper and Japanese assets such as equities and real estate are at a discount for foreign investors. On the other hand, there are downsides including the higher procurement costs for raw materials. How is the exchange rate impacting JESCO? Do you see it as more of a positive or a negative?

JESCO traces its history back to 1970 when the company was established in Nishitokyo as an electrical construction company. At the time we had only 5 employees. Now we operate as a real estate company here in Japan through a group company called JESCO CRE which was established in January 2022. This company is a very new enterprise for us. The JPY depreciation was a big event for us simply because of the essence of real estate itself. For a while, it was kind of a stable situation because of the margins, and we are balancing based on the number of assets we have with the increased price per asset that we are seeing in the Japanese market. This relates to the essence of real estate I mentioned, and with more increased investment from foreign investors, the price of domestic assets increases also.

Fortunately, with our company’s position, we can see the fluctuations in this depreciation and thus can benefit. Stability is important for any business out there, and this is especially true for real estate. There are so many changes happening in our daily lives, so we have set up JESCO CRE to be flexible enough to ensure the sustainability of the business despite any drastic changes around the world. Forecasting is important, and by that, I mean the analysis of market tendencies.

As I’m sure you’re aware, Japan is very vulnerable to various natural disasters and the ongoing global warming situation. Seeing the wider perspective of what is happening in the world around us and predicting these natural disasters is something we can do to some extent. That is why we can gather and prepare infrastructure and equipment to be ready for when these disasters strike. Honestly, this approach to disaster prevention is something that every company in our JESCO group follows, including our newest group company, JESCO CRE.

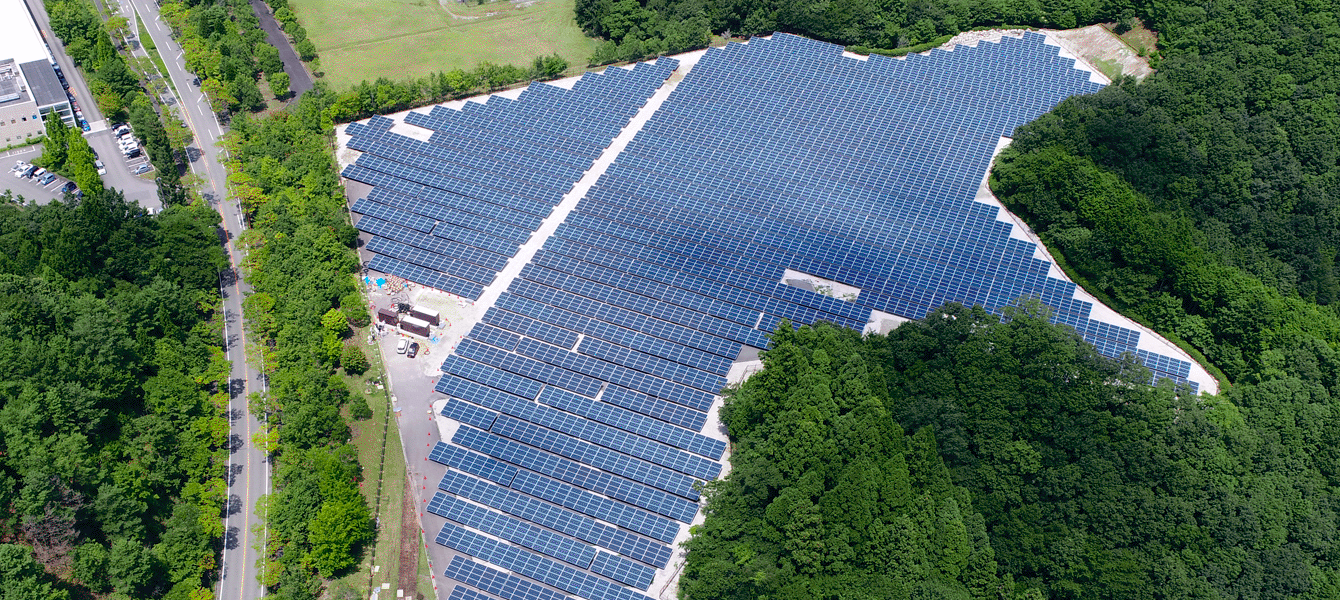

Eco-friendly solutions such as solar panels and other green sources of energy are something that the group as a whole is putting bets on right now. Our country of Japan is very dependent on energy imports, and the country doesn’t produce much energy of its own. I would say however that nuclear energy would be an exception to that. In recent years with the push towards carbon neutrality, the country has become more dependent on alternative energy sources such as wind, hydro, and solar. These alternative sources are actually a foundation for our business and we can provide appropriate solutions to interested potential clients.

We have seen a good effect from stock exchange activities in the stock exchange market. We have completed a couple of mergers within this 1-2 years we have successfully increased the dividends we are offering to our shareholders. In fact, the number has doubled in the end of 2023 August from JPY 15 to JPY 30. I think this actually proves that our company is a solid choice for investors because we are trustworthy and have an excellent track record.

Could you tell us a little bit more about your involvement in solar power and your recent alliance with J&T Recycling Corporation?

This is creating a good job cycle for us because we are a solar power solution company.

As for this partnership, we are now able to provide services spanning the entire lifecycle of solar power generation, including recycling. J&T Recycling Corporation is a recycling company that is also engaged in the recycling of solar panels. Beyond 2030, there will be expected to be a significant increase in the disposal of solar panels, and through our collaboration with J&T Recycling Corporation, we focus on not only recycling but also undertaking renovation and repowering projects. I think this is a win-win situation.

From your perspective, how do you see the evolution of the renewable energy market in Japan? Do you believe that Japanese companies can create technology that doesn’t rely on a feed-in-tariff (FIT) system once government incentives are scaled down?

I would say that it is necessary right now to create cheaper alternative sources of energy. We as a company don’t actually depend on the FIT system because we are an intermediate company. We provide solar panel infrastructure as a solution to companies that provide energy.

We provide a service that is quite simple compared to companies that sell energy. The installation of large quantities of solar panels is something that we do. Those solar panels have a life cycle of around 20 years. We have formed a business partnership with J&T Recycling Corporation to safely handle the recycling of end-of-life solar panels.

Some have resorted to burying solar panels into the ground when they are no longer in use, but this is a very dangerous way of dealing with the problem. A lot of the panels produced contain lead, something that is poisonous and very dangerous for humans. That lead has to be taken out and completely segregated. I think the recycling activities we conduct do require some incentives from the government. These incentives help us make this recycling happen and bring it up to full scale.

In terms of other sources of energy, I do know that current nuclear power plans from the Japanese government are currently on pause. We did suspend the field about the nuclear energy space in 2011. We are aware however that the government is looking to resurrect the nuclear energy space within Japan but public trust in nuclear power isn't exactly high. In my personal opinion, I don’t think Japan can ever get back to the way it was before because of the Fukushima disaster.

What do you think is the right energy mix for Japan?

When we talk about renewable energy sources we are talking about wind turbines, tidal energy, and solar power. So my personal ideal energy mix would include hydrogen. This is something that can be utilized 24 hours a day, 7 days a week. It is known that hydrogen is more reliable and safer, but of course, there needs to be a lot of infrastructure around it to ensure safety. If there is a legitimate way to go with hydrogen we would like to be involved.

With Japan being an island nation, wind power is also another viable option. There is a lot of wind hitting the shores and mountains of Japan, and the wind blows in different directions all across the country. What I’m trying to explain here is that although there is plenty of wind to be utilized here in Japan, because of the complexity it is quite difficult to capture. Solar is another reliable option, but then you have issues with day and night cycles. We as a country cannot be totally reliant on solar, rather it needs to complement other options. Realistically there needs to be a mix of everything and all types of infrastructure need to be built to support these options.

Ideally, I would love to see Japan go in the same direction as Europe, however, there the predominant energy source is nuclear, especially in countries like France. That requires more governmental policies.

The Solar Panel Project Managed by JESCO

Magna Telecommunication industries was one of the companies you’ve acquired over the past year through M&A activities. You’ve also acquired Akuzawa Denki as well as PEICO. Could you quickly run us through these recent acquisitions? What was the reason that motivated your acquisition of these companies?

I think the best outcome we’ve received from these acquisitions is human resources. Japan as you might know is a shrinking market in terms of human resources and Japanese workers aren’t always the best at sales. What we have with this declining population is also a shrinkage in the number of experts, especially in terms of solar power. High-quality human resources that have expertise in solar power are becoming a scarce resource, so we felt that M&A activities were almost a necessity. We wanted to utilize the expert human resources that other companies had. A headcount of around 210 people came as a result of these mergers, and one-third of that was 1st class of electrical construction management engineers and 1st class of telecommunication construction management engineers. These human resources are essential to create the foundation for future businesses to prosper.

If we were to recruit exclusively from university graduates, the reality is that they lack real-world experience. Ideally, we want recruits to have at least five years' worth of experience in the industry. Our bright future is very dependent on the expertise of skilled operators. Without those people, our business simply doesn’t work.

PEICO was a Vietnamese construction company you acquired in 2022. Experts are predicting that Southeast Asia will experience the highest growth over the next five years when it comes to new construction projects. What are your thoughts on Japanese companies entering Vietnam?

We are seeing a lot of Japanese companies looking to localize their production in Vietnam, and we as a company still believe that Vietnam is somewhat of a hidden gem. The population is on the rise, with many people living there and the fact that it is an economically developing country, there are still many opportunities to take advantage of.

I think that Japan and Vietnam have similar mindsets and the people of both countries are known to be very hardworking. Additionally, the two countries have had good relations and continue to do so to this day. I would say that Vietnam is now reaching its peak right now in terms of economic boom periods, and now the country is entering a stability period.

Big European and South Korean companies are looking to Vietnam for factories, and we have seen this trend all across the ASEAN region. With the COVID-19 pandemic, many companies looked to get out of China and the ASEAN region proved to be a great alternative. Have you felt like relocation out of China to ASEAN is the ideal solution to avoid the China supply chain risks? Aside from Vietnam, are there any other countries in ASEAN that you would like to further expand into?

Before Vietnam, we did have a presence in Malaysia. Our strategy right now is to penetrate markets with growing populations that are also growing economically. In terms of concrete targets, we are thinking about India which is another country experiencing an economic boom. Overall there are a lot of people living there and those people are very knowledgeable, especially in mathematics. This is a crucial skill for building infrastructure and telecommunications. India is showing a lot of promise right now.

Are you looking to continue further M&A activities in the future? What is the investment strategy of JESCO over the next three to five years?

Three companies in one year was a big number and it isn’t really normal for us. From an outside perspective, it looks great, but in terms of management, it is quite difficult to do. Additionally, bookkeeping is a nightmare when you are acquiring three different firms in a single calendar year.

I think next year we will look to acquire fewer companies over 12 months, perhaps only one or two companies a year. This is something that is set in the mid-term strategy plan, so I would say our business growth will depend on our M&A activities. The growth will come from the expertise and knowledge we acquire from other companies, so these sorts of activities are required.

Over the past two years, JESCO has posted very good performances with your finances. At the end of August 2023, you achieved the highest net profit in the company's history with sales of 11.1 billion JPY, an increase of 7% from last year. What do you believe are the core reasons for this solid financial performance?

I believe that the JESCO Group has achieved such positive results through mergers and acquisitions, leading to the overall growth of the group. The three affiliate companies we acquired, are now operating autonomously without our assistance. Additionally, with the acquisition of these companies, JESCO has also expanded its business portfolio significantly. Thus we see a lot of requests coming from Japanese customers who require the services of our new subsidiaries. I think that overall we have worked hard to create a good foundation, which in turn has resulted in good margins and good profitability.

We are also seeing profitability coming from real estate and additionally, as I mentioned earlier, we are benefiting from foreign investment too. They see a lucrative business buying, selling, and even renting properties here in Japan. The JPY depreciation is creating a good situation for business opportunities for foreign investors. This became a good source of income for the company.

Is there a new sector or service you are looking to expand into more?

We cannot necessarily specify a new service because we capture so many. Real estate may be one avenue because the returns are very good. One thing to not forget about is engineering and that is how we started our company. JESCO is always going to be pushing forward in terms of an engineering point of view, creating better services for customers. Of course, further engineering services do need to be complemented with further human resources and even further than that we do feel that these days IT experts are also a necessity. To put it very simply; we need more expert engineers.

You seem very excited about JESCO CRE, your real estate venture, especially since the performance so far has been very positive. What are your ambitions for the future of this real estate market? Are you looking to expand your operations in real estate and what particular segments or sectors are you looking at in particular?

Real estate is very dependent on different transportation hubs, and a good example is the development of a new line between Ishikawa and Fukui. When that is completed the concentration of people is going to become greater and the number of users of the Shinkansen in the area will grow. People simply build more buildings where there is a greater concentration of the population.

When you look at some of the mega-cities in Japan such as Tokyo and Osaka, they are still growing. We see more potential to acquire more assets and build more residential areas, even in Tokyo. In Japan, in particular, people have this mindset of collectivism, and they tend to gather around one area or spot. All across the different prefectures, in the center is a big city where most of the population lives. With that comes a desire from people to live better lives, and therefore there is an opportunity to create better living quarters.

The Japanese real estate market has been very interesting for the past year and a half. Land prices in Tokyo and other main metropolitan areas have increased faster than they have in the past fifteen years. Now we are seeing a strong rebound in retail and commercial properties since COVID-19 died down and the borders opened. Even offices have been more resilient through changes such as satellite working practices. As such, the price of new condominiums has increased drastically over the past year. With that incredible growth in mind, what type of properties will you focus your real estate resources on moving forward?

Kagurazaka is a particular area we have an interest in and just last week we purchased a mansion there. We don’t tend to purchase mansions that much, with our company tending to focus more on things like office buildings.

The quality of people here in Japan is quite an attractive point for foreign investors, and people from abroad who have the means would like to settle down in Japan. They like the higher level of safety and the higher quality of life. Additionally, there aren't any problems with illegal immigrants, and we have one of the best economies in the world. Of course, there are social problems such as the elderly population and the fertility rate, but I think the pluses vastly outweigh the negatives.

Being an island nation Japan is quite blessed, and when you compare it to some European nations Japan doesn’t have to worry too much about illegal immigrants crossing the border. Economically and politically, Japan does have its advantages as an island nation. Although there are negatives, I feel that due to all the pluses, Japan is a very attractive place to live.

The two big worries from foreign investors are the decreasing demographic line and the change in interest rates. Today Japan has one of the lowest interest rates in the world, especially compared to Europe and the US which are increasing their rates to combat inflation. Many investors are scared that if the Japanese government suddenly raises interest rates it might crush the appeal of the Japanese market. How do you feel about these two threats to real estate investors?

It is hard to say, and the specific problem you mentioned about the interest rates is something that we expect to deal with in the future. There have been big promises from the Bank of Japan not to interfere with interest rates for the near future, however, we are not exactly convinced that will stay true for the long term. The truth is that there is a risk with the situation as it stands and it is hard to sustain this level of interest with inflation as it is right now. Still, there is a good gap here even with the potential interest rate hikes coming in the next few years because we are still able to provide a good yield through assets to customers as stocks or on a rental basis. The assets we rent out are still making a good profit for us or our customers, and that will remain despite interest rate activity.

You have to remember that real estate is also just one part of our business, and at our core, we are more of an energy-related services company. Telecommunications, nuclear power plants, construction, and everything else we are known for all combine to create JESCO as a whole. The idea of interest rate hikes might be dangerous to companies that are purely real estate-oriented, but we have so many different businesses that we can cover for shortfalls by increasing our focus elsewhere if needed. Imagine you buy a property worth around JPY 1 billion and you are then renting that property out for a certain period. Throughout this process, the bank is going to come up with different policies. Realistically the pure buy-and-sell companies are going to be the ones that are worried about the activities of the Bank of Japan. As we are renting we are relatively safe because we own the underlying asset and during any time we are renting the property we are making some sort of profit.

Mr. Matsumoto, we saw that you were nominated in the Good Ager Award of 2023 next to singers and celebrities. As one of the businessmen to receive an award this year, why do you think you were nominated for an award?

Honestly, I’m not even sure myself either, but I was recommended for an award. As the Chairman of this company, I was selected by the magazine although it isn’t targeted at entrepreneurs. I’ve been on this earth for more than 80 years now, so perhaps longevity was a key reason, and it was a very nice honor to be awarded a prize. I think that this year they were selecting people based on different criteria and with a long history of corporate ethics and philanthropy our business is in good shape; possibly a reason I was highlighted.

There have been a lot of changes in JESCO over the past year, the most notable of which have to be the acquisitions. Now that you have completed these acquisitions, what is the long-term vision of JESCO? What are the next steps in terms of expansion?

The company has a lot of goals and ideas to reach new heights. I think first we need to step away from the numbers because of course the company wants to achieve certain amounts of sales and margins, but that is true of every company in existence. At JESCO we are trying to not focus too much on the numbers and focus more on the prospects of contributions. Those contributions are both domestically and overseas as well. On an employee level, we would also like to make contributions, and we really want our workers to feel happy and fulfilled with their work. The key here is not necessarily being a big company, but rather being a good company. The recent history of the company has been very successful, and we would like to continue that story long into the future.

0 COMMENTS