By aggregating partner manufacturers, CADDi has managed to provide a unified procurement platform for sheet metal, machining, framing, and plastics through their proprietary platform that aims to unleash the full potential of manufacturing.

Japan, especially in the manufacturing industry, has been admired for its implementation of robotics technology. However, it has been often criticized for its slow adoption of digital technologies and tools, with many systems still being analog based. Why do you think that is, and as a digital company at its core, how do you believe this is changing here in Japan?

This is quite a difficult question. I’ve worked with US companies as well as companies in the Netherlands, Iceland, and China. Last month I visited Vietnam and Thailand, and digitalization in the manufacturing sector is not so different, and that is my opinion. They are not really digitalized and there is still a lot of paper. I mean honestly, it is pretty much the same with even US companies. Take for example a factory floor, if you are working in that environment and you want to write something down, it's difficult because your hands are dirty, and you don’t want to be touching a screen on a phone or tablet. In that scenario paper and pencil makes much more sense. In these factories, it is really not that different from country to country.

The number of SMBs in Japan is higher than in other countries, and that could be one reason why digitization is not so popular to do right now. I think it is actually very simple, it’s a return on investment (ROI) matter.

If you go to a small factory, there is usually an office on the second floor and the owner sits there. If they go downstairs and look at the factory floor, you immediately know how it works and what is going on. You can see what kind of products are being used and who is working at what station or machine. The return is very small regarding the management system, and I think this comes down to being able to manage a factory just as efficiently with traditional pencil and paper. So now consider the fact that the return is small, yet the investment is high, and you will come to the conclusion that it really doesn’t make sense. Now you can understand why the penetration is low, especially in SMB sectors. As I mentioned, the number of SMBs in Japan is high and the digital penetration is low among them, and I think it comes down to a mixture problem.

What we are trying to do at CADDi is lower the investment, and at the same time make the return higher. We start from drawing which is the most important data and will then expand that to other data like factory planning data or customer data. We connect all this and make it into a kind of asset for that company. We created that software as a service (SaaS) and the initial investment is very low, because the fees are charged on a monthly basis. If we could know their production status precisely, we would be able to place more orders more efficiently. Using our system will dramatically improve their bottom line.

At the core of your company is this matchmaking system, could you speak a little on this setup?

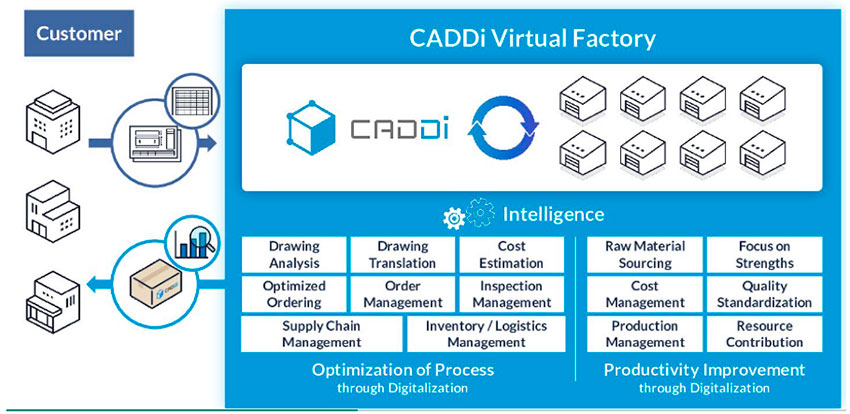

I don’t really like to think of our company as a matchmaking company because we not only match suppliers and buyers, but we also quote the price and assure the quality by ourselves. Also, we supply materials to our partner factories and supply on their behalf. If you were to think of our company as a factory, well then we are the biggest factory in Japan in terms of processing power. We probably have the biggest negotiation power with material suppliers through trading companies, so that is why we source parts from them.

When preparing for this interview we met with many traders that offer a similar type of service to your company. What is the difference between going to a trader or using CADDi’s services?

There are actually a lot of differences, and often our customers see us as the biggest factory in Japan that is virtual in nature. Factories by definition own quality, cost, and delivery (QCD) responsibilities, and they produce parts. We do not produce parts, and instead, we assure the quality by leveraging our five quality assurance centers. We assure the quality, cost, and delivery all by ourselves by using our systems and manual support.

CADDi Virtual Factory

Imagine you are the owner of a factory. I think the biggest problems factories face is that they get a lot of quotations, and the head of sales will send those quotations back to the customers, however, out of all of those potential deals to be made the factory may only win about 20% of those, and lose about 80%. That is the average in Japan at least. Matching platforms would receive random orders and quotations from customers, and select around 5-7 suppliers and make quotations based on that, even going as far as to post on their website. Suppliers can see these quotations and then compare, finally selecting what is considered the best one. It doesn’t really change this whole quotation process, and in fact, the win rate might be lower than the original way. Even more, customers care about QCD, so if the platform doesn’t do QCD then it doesn’t make sense.

In procurement, the cost is super important. Some players in the world match the suppliers in the matching platform using 3D CAD data. This data is used by designers and engineers, and they don’t really care about cost, rather they care about delivery because they create prototypes to understand if the parts actually work. Procurement companies really care about costs, and their priority is to reduce costs. If a platform takes a margin, the price will be higher than the original, right? So the question then becomes “How do we reduce the cost?”

That is very important, especially when we want to give out advice on procurement, so let me tell you a little about how CADDi lowers the cost. First, we have a sort of negotiation power that we like to refer to as aggregation value. We aggregate the volume to lower the price of materials. Also, we are creating the CADDi Factory System, which is similar to the Toyota production system. We asked ourselves how we should manage high-mix-low-volume products, and in that industry the suppliers are super-fragmented. Each supplier has very specialized strengths, but nobody knows who has what strengths, it is super hard to identify. That is the key to the matching platform; its ability to match the best supplier for the task.

We have three values that we refer to as matching value, aggregation value, and system value. In terms of matching value, we know how the supplier processes the parts and how they create the parts in great detail, and that gives us the ability to calculate the cost. If you want to calculate costs, it can’t be an AI thing, instead, you need to break down the processes and the cost structure.

Let’s take for example a company that is good at sheet metal, and this is super rough and superficial. On our platform, there are 500-1000 smaller categories within sheet metal because we know the both processes and the quality very well.

Another key to lowering costs comes down to this aggregation value I mentioned earlier. Material aggregation is a big key, and we aggregate similar parts to one factory so that they can reduce what we call base setup costs. The cost of manufacturing is divided into three things, one is material, one is processing costs, and final one is preparation costs. These three aspects combine to make base setup costs. When you want to create something you need to set up the machines and the tooling, and especially for the high-mix-low-volume industry, those setup costs are very expensive. You have to change the setups for one product again and again. The key in the high-mix-low-volume industry is a way to reduce this setup time, and we think that the key is to aggregate similar products. Obviously, no one customer is going to order the same designs or parts because they are customized for each company, but despite this, there are a lot of designs that are similar across customers, so we aggregate those designs and send those to one supplier. That supplier can then aggregate 3-4 of those designs into one process. Take for example a series of similar components, the supplier may have 3-4 processes to complete the part. They are now able to aggregate a few of those processes because perhaps they are identical and the parts only differ because of later processes in the manufacturing line. This can drastically reduce not only setup time and processing time, but also material costs.

Finally, I will talk a little about system value, which is designed to reduce suppliers' operational time. Normally suppliers might have to allocate time for sales and quotations to customers, but if they receive an order from us they obviously don’t need to sell to us. We like to say “quotation less transaction,” when referring to this, and we already are fully aware of their processes. They might want to check the quotation themselves of course, but we calculate the costs on their behalf. We support them by providing a complete breakdown of the costs and this quotation model is widely regarded as better than their original quotation model.

A good example can be seen in my recent trip to Vietnam where I created a cost model for one of the biggest machining companies in Southeast Asia. There is a lot of customization required to adapt and it can take up to 2 months. We take a lot of data from the machines to make the cost model, not their quotations. There is actually a huge gap between their original quotation system and our real-time data, with their model being plus-minus 40% and our model being plus-minus 5%. That is why they trust our model.

One more thing I would like to state is that we do not do competitive bidding, and will never send a quotation to more than one company at a time. We just send the quotation and the supplier will see it as an order and not even really look at the quotation. There are many things we are managing on their behalf. If you look at a typical design, it takes time to calculate the material costs. You have to analyze the design and then ask for a quote from a material supplier. Three days later you might receive that quote and it might not always be to your liking. That is a lot of wasted time, so it is a huge advantage for companies that we as the platformer already know the material cost and weight, and on top of that we also already have the supplier for those materials. We just send the material costs to them and they don’t have to waste their time and can get right down to producing. By providing the system value we are able to significantly reduce their operational costs.

Factory in Japan

We are not just a parts catalog, we are in fact dealing with very customized parts and a very customized experience for our customers.

It seems that you take a very unique approach to problem-solving, where first you figure out the problem from the customer’s point of view and then you work your way backwards towards the solution. How did you first stumble upon this problem and decided to establish CADDi?

Going back to my university days I had my own company, and it was a medical-related business, and I wanted to create a bigger company that provides bigger value to the world, but I didn’t have any ideas on the deeper issues. I ended up choosing to work for McKinsey because I wanted to know the deeper issues that the management or top companies have in each industry. Secondly, I didn’t have any experience working globally. I did a lot of projects in a lot of sectors and one of the biggest practices of McKinsey in Japan is called industry and functions and is related to procurement for manufacturing. I was the leader of that practice, and for the last two years I’ve spent most of my time in this sector serving 15 major clients around the world, and they had mostly similar problems in terms of procurement, especially in Japan.

As you know the GDP of the manufacturing sector in Japan has declined 6% in the last 20 years. The US however has seen an increase of 51%, Germany went up 89%, and of course, China has seen an increase of 865%. Japan survived by focusing on cost, because there is no growth, and by reducing costs they can become more profitable. Companies thought about how they could create the parts they manufacture, but at a lower price and a shorter time frame, and this is why we spent a lot of time at McKinsey supporting that.

What companies do within the high-mix-low-volume markets is actually super simple. They compare prices among the suppliers and then negotiate with them, and this is no different when comparing Japan with the US. However, when there are lots of parts involved those companies really cannot afford to spend too much time on reducing the costs of parts. They aggregate and compare suppliers, pick the best one and finally order the parts needed, and this kind of practice is no different all around the world for manufacturing. I quickly realized this was the case, and what we did at McKinsey was to break down the cost of the basic materials and then build up that cost structure, however, it takes a super long time and this is why we cannot do something like this for all the parts. Take for example something as simple as a water bottle, this breakdown could take up to one week. This is where I thought about the idea of automation, and if I could take this procurement model for cost reduction and make it an automated process that could be something very valuable to companies looking to make big strides in reducing their costs.

I thought about the idea of some of these procurement companies. They might have to procure say 1,000-10,000 parts per month. If they had a breakdown of all of those parts, can they leverage that data to negotiate with the suppliers one by one; probably not. They don’t need a breakdown, they just need the parts at a lower price. That was when I started to think about a way to produce the parts at a lower price and send that to the customer with QCD assured. This is the beginning of CADDi.

Currently inflation is running rampant across the world, US interest rates are increasing at an unprecedented pace, and the JPY is plummeting. Material costs are changing all the time. How do you keep up with this data, and in this environment where supply chains are extremely disturbed? Does this represent an opportunity for your business?

It is actually a huge opportunity for us, especially in Japan. Procurement companies are very consumptive and they care a lot about QCD, therefore they don’t want to change their suppliers because it is risky. In the situation we are in right now however, they cannot buy the parts, so of course, they need to look for new suppliers. We can do what normal factories can’t do, and I think that manufacturing factories find it difficult to scale up. We afford those manufacturing companies the flexibility to increase or decrease their volume, and that is why I think they select CADDi. Right now, we are growing at a volume of 400-500% per year, meaning that we are growing quite rapidly. I think this might be down to the problems with supply chains and the semiconductor industry shortages.

With the semiconductor boom, it is super difficult to scale up the capacity rate and that is why they work with us. When you consider the famous manufacturing process of Toyota, the just-in-time (JIT) method. The basic principle is to not keep stock, but now stock is super important. Semiconductor manufacturers probably have around 6 months of stock right now if not 1 year, so things have totally changed. This all presents very good opportunities for CADDi to take a foothold.

In the post-COVID world, there have been serious chip shortages, and many governments are providing huge incentives for local chip production. With all of these regional pushes to revitalize semiconductor production, how can you latch on to this momentum as a service provider internationally?

We do sell parts to semiconductor machinery manufacturing companies, and we also have a plant division. When you create a silicon fabrication you need to have these kinds of big piping structures to purify the water. We serve water purification companies and a lot of the piping components are provided by us. As you mentioned there is a huge amount of momentum right now and we will expand our business to the US in the near future. The US is short on supplies right now, so if there is a need we have the parts.

We saw in our research that you acquired a patent from a US company that is involved in the machinery field. Why does that make sense within your business model and can you tell us a bit more about your activity in the United States?

To be honest it is not a big deal to buy something from outside. If we can leverage something then we will leverage. One of those was a patent that was owned by Plethora, which is a manufacturing system that turns customer designs into custom parts using robotics and advanced software. Again, however, our value comes from our matching aggregation system, and the system isn’t limited to only software but also applies to the operation. For that reason, our software is super important and we have many AI engineers internally. We have the intention to expand to the design field, the engineering field, and the manufacturing field. Procurement by nature is connecting manufacturing and design, so CADDi sits in the middle of that so we can provide advice to engineers to help with cost reductions, and I think there is a huge amount of value in that. That is why we will be connecting those two things together.

Designers know what they are designing, however, they don’t know how difficult parts are to make or how costly they will be. That is why we give feedback to them in terms of cost and ability to manufacture. The patent we acquired will be helpful in strengthening this capability.

In March 2022 you opened an office in Vietnam and since the pandemic and China’s repeated lockdowns, we have seen a lot of production bases move in a quest to diversify and lessen their reliance on China as a manufacturing base. Why did you decide on Vietnam and in the future are you looking to further your network in the Southeast Asian region?

We are actually expanding our offices into Thailand as well. Actually last month I went to Thailand for three days and during that trip, I decided to create an office there. Now we have Hanoi, and Ho Chi Minh City, as well as in the near future Bangkok as well.

Many people say that it must be for cost reasons, and that is partially true. The true reason is that we need capacity because we are growing rapidly and scaling up. Manufacturing capacity is super difficult, especially for smaller companies, so our biggest criteria for selecting a supply partner is a willingness to grow. In Vietnam, the macro is growing and most of the CEOs of their factories are their founders. Those founders only founded their companies maybe 10-20 years ago and therefore are still growing. Their willingness to grow is super high and that makes them a great match with our business.

From the beginning, we have always wanted to expand our business globally. Japan has trainees from overseas and the country that contributed the most to that was Vietnam. This means that there are a lot of Vietnamese who not only can speak Japanese but also understand Japanese quality.

You talked earlier about Japanese procurement being very conservative, and that companies put their trust in CADDi. How do you assure them of that trust?

It’s a step-by-step process, and now around 70% of top machinery companies in Japan are our customers. For the first 2-3 years they didn’t trust us, and in fact, some small companies didn’t trust us purely because our company name is written in katakana. I think it was a case of them not trusting foreign companies. I mentioned to those companies about golf caddies, and told the owners how when playing golf they trust their caddies, so why not trust our company; CADDi? It was super difficult to get any trust because it is such a closed industry. Most of the manufacturing and materials are made in Japan, which is a good thing, but it creates a high barrier to entry.

COVID-19 kind of accelerated our growth, because manufacturers had such a hard time finding new suppliers because of procurement issues. It is quite difficult to take margins out of a transaction because customers need a cheaper price, and sellers do not want to sell at a cheaper price. Therefore we felt it was a very important investment to get this sense of trust and a key to that was the financial investments we made in quality assurance. As I mentioned earlier we now have 5 quality assurance offices across Japan already, and 3 of those were opened up last year. Based on the data we were able to change the supplier for each part and give feedback to the customers. This feedback is valuable to them and they are able to use this data to adjust their designs, lower their costs, and ultimately retain a level of high quality. This has gained us the trust of some top companies, and as you know, if you get the trust of top companies the others will follow. It isn’t a magical thing that you can instantly obtain, and trust is something that will always require a slow, steady, step-by-step approach.

The idea of aggregating together demands to then have leverage when negotiating with suppliers is such a simple yet genius approach. Are you scared that someone else is going to copy your business model, such as a big trading firm?

If I’m being completely honest what we do is super difficult. In our technology group, there is a top ranker at Kaggle, which is a community of about 400,000 people involved in machine learning and data science around the world. We have more highly ranked engineers from over 10 countries worldwide. It is quite difficult to attract those talented engineers within the manufacturing industry. Top engineers pick companies with top engineers, so you get this kind of cycle. Our CTO,the co-founder with me, is a gentleman called Aki Kobashi, and he is a former engineer from Apple where he worked on mobile products including the iPhone. Later on, he worked as a senior engineer on the development of embedded products such as the Airpods. This is a super attractive proposition to work with someone with such experience.

Another thing is data, and data really matters. The more data you have, the more value you can create, and that contributes to the quality side too. Operations too, matter to many companies, and with CADDi’s systems we can offer support services to many factories, and our engineers have expertise from big companies such as Toyota, Honda, and Nissan. Production engineers do a lot of cost reduction, and their expertise with such companies carries over and makes the services that CADDi offer that much better.

One more thing to mention is the size of the market itself. The latest estimates put the procurement market in Japan alone at a whopping JPY 1.2 trillion. That is a super huge market and it is practically impossible to control that entire market with a single company. That is why we don’t really need to worry that much about competitors because essentially the market is big enough to accommodate multiple big players.

If we were to come back in 5 years' time on the 10th anniversary of CADDi and have this interview all over again, what would you like to tell us? What would you like to have achieved by then?

My personal goal is to unleash the potential of humans, and my business goal is to unleash the potential of the manufacturing industry so they are very related. Our goal by 2030 is USD 10 billion in transactions, and in terms of globalization, we aim to have major manufacturing in 30-40 countries worldwide. We plan to have the entire basic operations of the company automated by then, and we are currently creating technologies to achieve that. Converting data into an asset and leveraging that is our concept, and we foresee unleashing the potential of manufacturing through the digitalization of manufacturing management.

0 COMMENTS