Amidst an evolving automotive landscape and a challenging demographic shift, Hirano Seisakusho of Iwate, Japan, stands at the forefront of innovation and quality. By blending traditional Japanese craftsmanship with strategic global partnerships, the company navigates the complexities of modern manufacturing, from EV advancements to the nuances of international collaboration.

I would like to start with a brief introduction of your company. What are Hirano Mfg.'s main capabilities and how do you differ from your competitors?

We are based in Iwate, Japan, and are always looking for ways to do business with companies based in the core mainstream of Japan, primarily in central Japan. Our strategy has been to expand our sourcing to Asia, especially China and Taiwan. By taking advantage of these locations and working with major companies like Komatsu, we have been able to expand the plants of some of the largest companies in Japan. We see ourselves as a manufacturing company with a hybrid manufacturing system, with multiple locations in Asia and Japan. We have invested heavily in metalworking machinery for major companies. The differences between our company and Nagatsu will be explained later, as we have similar product lines in the same field.

Over the past 25-30 years, Japan has seen the rise of regional manufacturing competitors such as China, Korea, and Taiwan. These companies have copied the successful Japanese model but have done so at lower labor costs, thus displacing Japan from a certain group of markets. However, we still see Japanese companies as leaders in certain niche B2B sectors. With that in mind, how do you think Japanese firms have been able to maintain their leadership despite intense price competition?

We have manufacturing partners in China and Taiwan, and our partner system allows us to produce the products needed for the Japanese market. In this sense, the strength of Japanese companies is their ability to understand the needs of the Japanese market, especially in terms of quality, which can be difficult for Chinese and Taiwanese companies.

At the core of many Japanese companies is a commitment to quality, but since quality is often equated with additional costs in production, it can be very difficult for foreign companies to understand the high standards for quality set by Japanese companies. As a Japanese company working with foreign producers, it is important to always provide the necessary technical support and remain focused on quality to meet the standards of the Japanese market.

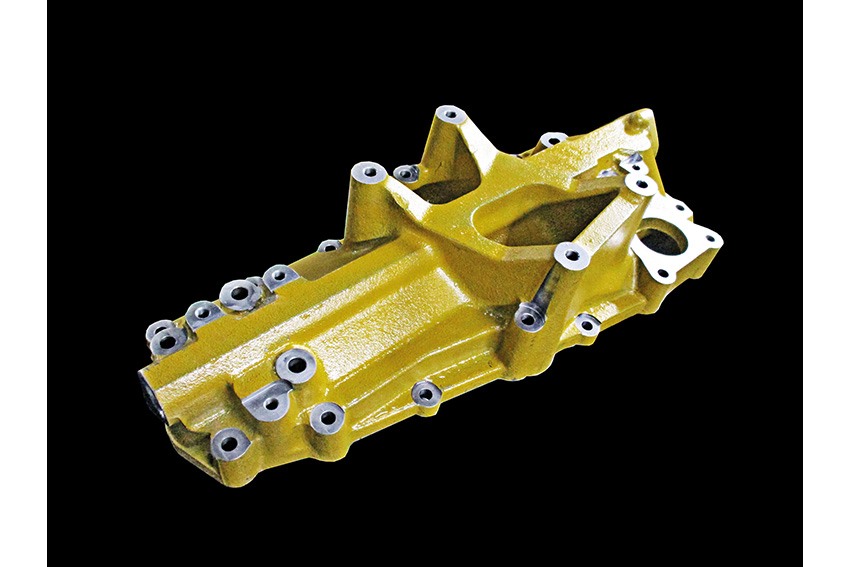

Capacity case for construction machinery

We often hear complaints from Chinese and Taiwanese manufacturers that Japanese companies demand too much high quality at a low cost. They tell me to lower my quality standards because they are too high compared to European companies, but I always insist that Japanese quality comes first and that products will not sell if quality cannot be ensured. When dealing with Chinese and Taiwanese manufacturers, this must always be emphasized.

You may wonder why a Chinese or Taiwanese company would want to partner with a Japanese company, but I recently received a letter from a Chinese supplier thanking Mr. Hirano for never once delaying payment or canceling an order. As a supplier, they feel that trust is an important aspect of our relationship. So while Japanese companies can be demanding, at the same time, they trust us very much. They feel that the fact that they can trust us is a huge advantage.

You mentioned that you would provide technical assistance to these companies to maintain Japanese quality, but it would be difficult to maintain that given the demographics of Japan. Japan is the most aged society in the world, with a rapidly shrinking population. In fact, experts predict that the population will fall below 100 million by 2050, and one in three people will be 65 or older. This is causing a number of problems, including a labor crisis and a shrinking domestic market. With that said, what is your firm doing to ensure business continuity?

As I understand it, this aging problem is now a global issue, not just a Japanese problem, especially in Asian countries. The only countries where the overall population is growing are African countries and perhaps Islamic countries. Overall, it seems that Japan is not the only country suffering from this aging problem.

Considering that we are a local Iwate company, it is important to increase salaries and make our company more attractive to young people. The primary goal of almost all companies is to make a profit, and we want to turn that profit into an investment in our employees. We are also committed to creating a good work environment that motivates our employees. Since motivation is key to employee retention, we must continually invest in new technologies such as DX and machining centers. These technological advances actually inspire the people who work for us. Another strategy we have adopted to compensate for our labor shortage is to move our manufacturing capacity overseas, namely to China and Vietnam, where the population growth rate is higher.

In the past, we have relied on Chinese suppliers, but we understand that it is important for us to diversify and mitigate risk. Relocating to ASEAN countries such as Vietnam, India, and Indonesia is important, and the emphasis will be on either finding suitable suppliers or establishing our own factories.

Oil cooler cover

When establishing a factory overseas, understanding the local people and culture is critical to establishing a presence in the region. To accomplish this, many companies look to partnerships as a gateway to these regions. Is finding partnerships in these regions of current interest to your company?

We are partnering with a supplier in Taiwan and have also established a joint venture factory in China. Recently, we have had internal discussions about the shortage of human resources in both Taiwan and China. Therefore, we need to expand into ASEAN countries such as India, Indonesia, and Vietnam. The joint venture we have established in Vietnam is our investment and is operated in cooperation with an aluminum manufacturer called Gravity. There are two to three shareholder meetings each year where we discuss how to grow the company, find the right markets, and develop the right products.

Your products are used in various fields such as construction machinery, automobile engines, and semiconductor manufacturing equipment. Are there any fields you are currently focusing on or any new fields or industries you would like to diversify into?

Diesel-powered construction machinery parts are a growing pillar of our business. This is due to the testing being done on stricter emission regulations for 2025, and design changes are currently being tested to improve engine efficiency and reduce harmful emissions. This sector is expected to continue to grow as more stringent regulations are implemented.

Meanwhile, semiconductor manufacturing appears to be growing rapidly worldwide. Unfortunately, there is not much trade in this sector.

Connector

So, jumping to your point, we are now seeing many vehicles switching from internal combustion engines (ICE) to EV, hybrid, and fuel cell-based propulsion. It is estimated that 13.3 million vehicles will be sold globally in 2024, representing 16.2% of global passenger car sales. As a result of all these changes, many components of traditional vehicles and construction equipment will no longer be needed, and ICE is just one example. What threats does this transition pose to your company? How are you overcoming them?

We have developed a motor case for EVs, and this development started about 20 years ago. This case, in particular, is for EV SUVs. Some of you may have seen it before, as it is used by Mitsubishi Motors and other major companies.

When it comes to EVs, it is a risk, but as I explained earlier, we were one of the first companies to actually produce components for EVs. These days the EV market is dominated by China and Chinese manufacturers, and frankly, they are modeled after Japanese cars. In fact, Toyota approached us 30 years ago to produce EV motor cases for the Prius, but we lost the bidding. However, we can say that the technology to make it happen is still available.

0 COMMENTS