With the ability to utilise both aluminum die casting and iron forging techniques, Yanagawa Seiki is providing high-quality and lightweight cover, cases, frames and shafts for the automobile sector, utilised by some of Japan’s most well-known firms.

In the last 25-30 years, Japan has seen the rise of regional manufacturing competitors who have replicated Japanese monozukuri processes, but at a cheaper labor cost, pushing Japan out of mass production markets. Yet, we still see Japan as a leader in many niche B2B fields. How Japanese firms have been able to maintain their leadership despite the stiff price competition?

Actually, to be honest, Japan is no longer a high-cost country. Maybe it might be better to say that it is a high-cost country, but not the highest. We can be competitive at a moderate cost level. Secondly, I think that Japanese companies are really good at managing costs, especially managing the scope or scale of the economy. We can utilize the same kinds of production lines and facilities for many applications. I think that Japanese companies, including my own, work smart in that way, so that we can produce unique products at moderate cost

You just mentioned that Japan is no longer a high-cost country. I think this is very relevant today. The JPY is at a historically low point right now, and due to the reliability issues brought about by China’s zero COVID-19 policy, we are seeing many Japanese manufacturers trying to bring their production business back to Japan. Looking toward the future, how do you see this situation evolving? Do you think manufacturing will eventually come back to Japan?

Well, I cannot conclude it that way, but I think this trend will continue. Our current global situation is unstable, and as you mentioned, many customers of these industries want to localize manufacturing and supply chains as a whole. Even within Japan, Kyushu customers want “made in Kyushu” parts to minimize the logistical risks.

Our subsidiary, Kyushu Yanagawa Seiki Co., Ltd.

Companies such as my own are always thinking about the balance between globalization and localization. Japan is no longer a super high-cost country, so if you think about the total costs, localization is offering some good options right now.

How does your company plan on taking advantage of this?

Many customers are thinking more about localized supplies. We are very aggressively discussing with our customers about local supply and development. We can produce better parts in Japan, that is just a fact. Obviously, the cost will be higher than in low-cost countries such as China, but when you compare the total cost and take into account the logistical risks involved with such countries, I think that the pros really outweigh the cons.

One of the challenges in bringing back production to Japan lies in the demographic situation. Japan is the oldest country in the world and has a shrinking population. Fewer people means less demand and a shrinking domestic market. Also, you have a problem in terms of labor. It will get harder to hire young talented graduates that can receive the skills and techniques of the older, retiring generation. How is your company facing the challenges of a shrinking domestic market and a labor crisis?

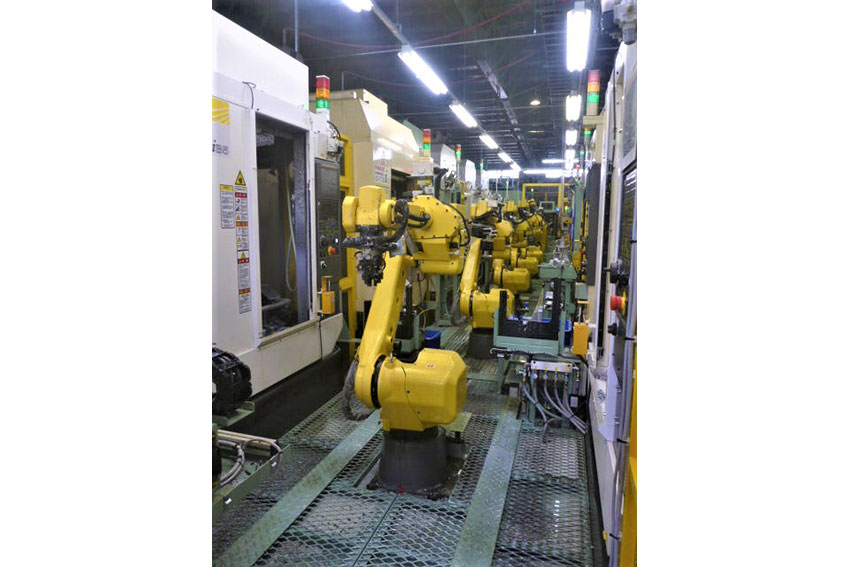

Overall, because we are located in Japan, we are facing these challenges, as are a lot of others, but I think we are managing well. I think the evolution of automation has allowed us to dramatically reduce the amount of physical work and operation workload. That means that elderly people can continue to work, and we have hired a lot of semi-retired workers already. Those people have good skill sets, experience and knowledge. Despite their physical strength not being what it used to be, they want to work and are eager to make a contribution. In a sense, we are in a win-win situation.

Because of continued automation, we do not need as many people anymore, especially when compared to 10-20 years ago. We are not completely automated, so we still require workers but I think our company strikes a good balance. Nowadays I feel we better utilize the skills of both our workers and our robots.

Automation can increase output as well as decrease costs. How are you adapting and implementing automated manufacturing processes here at Yanagawa Seiki?

Internally, machinery devices are becoming number controlled, and reducing a lot of manual labor. I think because of the good condition of the business, we are able to adapt the devices to many different products. Our main production is in mold design and manufacturing, and I think this is a key technology for us.

Can you give us some of the competitive advantages of the molds you create?

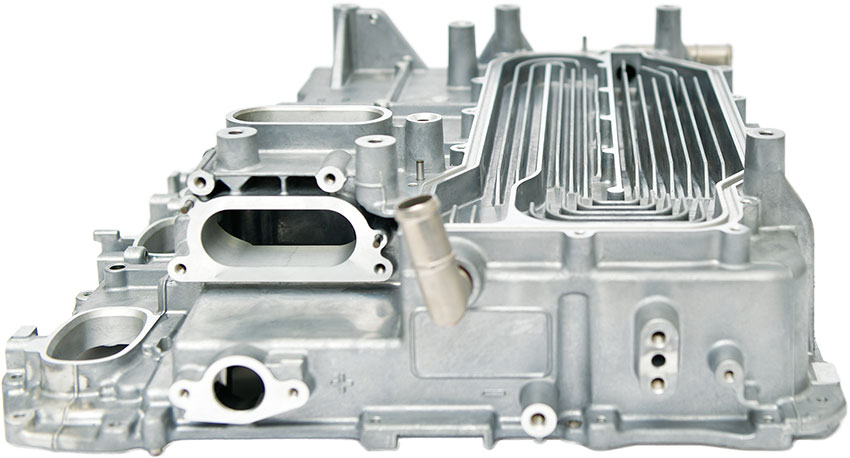

We produce a lot of engine parts and EV parts. These are very sensitive and we need to produce them based on very specific molds. They must be created using sensitive and high-quality technology. They cannot be made by many people.

At Yanagawa Seiki, you employ both hot and cold forging. Usually, companies tend to stick to one or the other. Why did your company decide to master both hot and cold forging and what benefits does that bring to your clients?

There are a lot of different technologies that can provide different features. During our history, we acquired a forging company and in the process, acquired forging technology that helped us broaden our offerings. Quite often a customer will not specify every detail of the process they require, while they very clearly specify the function, quality or feature they want. It is our job to make that happen. To do that, we need to have a broad range of technologies to meet those requirements. This kind of readiness is very helpful.

A lot of your clients are in the automotive sector, which is undergoing a major transformation with the switch to EVs. The average gasoline vehicle requires around 30,000 components, whereas an average EV only requires about half of that. This is due to the complexity of the internal combustion engine. Can you tell us as a company that supplies parts primarily for internal combustion applications, what steps are you taking to adapt to the shift to EVs within the industry?

For us, in a sense, the internal combustion engine and EVs are the same, because we are not an engine company. We are not producing electric motors or this kind of thing. We produce covers, cases and frames for these devices. In this regard, we need to sit down and discuss with a customer what their needs are and provide a solution for them. What is happening is actually customer changes. In the past, most carmakers produced the engines by themselves. What happened was a tier-one supplier became our customer. And I think the customer is shifting now from conventional carmakers to electrical device companies. These electrical device companies are very eager to enter the automotive industry as they see the huge potential but they are not necessarily fully knowledgeable with the business of this industry. We can collaborate with them and produce covers for their products so that they may meet the strict requirements of the automotive industry. We are talking with a lot of them at the moment.

Something that is often less discussed is the change in materials and all carmakers are trying to reduce the weight of their vehicles. How are you responding to these changes in materials? In your product development, what new initiatives are you bringing to meet the demand for lightweight components?

At this moment, we are not planning to introduce any completely new materials. Other than that, we are focusing on discussing with our customers design changes. We want to achieve an output that is lightweight and cost-effective. Even between metals such as iron and aluminum, while aluminum is lighter, iron is stronger and cheaper. Such devices still require iron, devices such as shafts and gears, that need an element of hardness in their design. We are always trying to figure out better configurations, and create balance by thinking about better design and functionality.

We know that you make subframes for vehicles, and those suffer a lot of mechanical stress under the weight of a car. Can you tell us how you ensure the safety of your vehicle subframes when they are in use?

Our newly designed subframe reduces the weight by 40% while maintaing the strength. At the design stage, structural and non-linear analysis were thoroughly carried out by CAE so that we could have full confidence with our design. At the manufacturing stage, material tests, strength tests, and durability tests were repeatedly executed, and, upon assembly, internal inspections were also conducted with X-rays. Strict tests were also conducted even after mounting on the actual vehicle. As a result of such a thorough quality assurance system, there is no trouble with mass production. We are very proud of such outcomes.

Can you talk to us a little bit about your original 4-pinion differential technology? What are its advantages over more conventional alternatives?

By realizing a 4-pinion structure, instead of 2 pinions, which was common, it becomes possible to double the torque capacity with the same device size, or, to significantly reduce the device size of the same torque capacity. The case of the differentials, which is usually manufactured by casting, is forged to realize a stronger structure. As a result, the wall thickness is reduced and the weight reduction is successfully made.

There are some in the industry who feel with the change to EVs, internal combustion engine vehicles will remain a kind of hobby for enthusiasts. Do you agree with this sentiment, and how quickly do you think consumers will transition to EVs, not only here in Japan, but worldwide?

Personally, I like internal combustion engines, I like the sound they make, so sentimentally I agree, but historically speaking, I think the internal combustion engine will go. Nowadays, people tend to talk only about the carbon emission issue, but, at the end of the day, we do not have an infinite supply of natural gas and oil. Before that supply runs out, humans will have to change to more renewable sources of energy. This will take place within this century and by the end of it, everything will have changed.

The Japanese automotive industry traditionally has been very pyramidal in structure, with tier one companies at the top. What do you think are the weaknesses of this keiretsu system and how do you think they will evolve in the years to come?

I think keiretsu has excellent intimacy among its key supply chain players, so developments can be made very efficiently. But too close and rigid relations do not necessarily produce the best effective outcomes, and that is why keiretsu is being broken. Business is becoming fairer and more transparent. I think it still is important to keep this intimacy with business partners and customers, but things should and will be more transparent and honest in the future.

Your company has worked very closely with Honda and Toyota, two very well-known Japanese firms. Are you looking to add any more foreign companies to your list of clients?

Actually, we already have businesses with other world-famous motor companies. We have a business located in the US and Thailand. We launched our US business to follow in the footsteps of Honda, but of course, we tried to develop our own business and succeeded in working with American companies. Also from Japan, we export our products to overseas foreign customers.

What strategies are you looking to employ to increase your international clientele in the future?

The interesting part is that sometimes those companies approach us. They are looking for a good supplier and we have a good reputation for providing complicated motor vehicle components. We might not be too aggressive to pursue non-Japanese clients, but , sometimes our direct customers develop international clients, that become our end customers.

Collaboration is very important to a successful business. Many Japanese firms take advantage of this to penetrate new markets, find new customers, or even develop new technologies. What role does collaboration or co-creation play in your business model and are you looking for any co-creation partners either here in Japan or abroad?

I think the concept of what a partner is has changed. In the past, partnerships might mean ownership partners, but now it is more about operational partners. We are not very aggressively looking for a kind of agent-type partner. Business is more of a network-driven type of thing these days and collaboration is the key. I have no doubt in my mind that the rules of the game are changing, so in that regard, we are very open.

What do you look for in a partner? Are you very open or is there a specific trait you are looking for?

We really need to think about how to survive and prosper in such a changing environment. We are talking to many industry players at the moment, and because we share the same issues, we are looking to find better solutions.

Can you tell us about your R&D strategy and are there any products you would like to showcase?

One thing I did not mention but what might be an important point is that we are not aggressively trying to introduce new materials beyond existing metals such as iron and aluminum, but even within aluminum, there are a variety of materials with different characteristics (some are stronger, some are lighter, etc.). We are sticking to our core competencies that are high quality metal processing mainly casting & forging, and provide high quality deliverables that meet and exceed customer requirements, by applying the best suitable materials (not drastically but incrementally changing) and processes (always being innovated), leveraging our accumulated industry experiences and know-hows.

You became president of Yanagawa Seiki just over a year ago: are there any goals or ambitions that you would like to achieve during your time as president?

My mission is to turn this company around. I was hired because the Yanagawa group was not in a good financial situation. A Japanese investment firm made an investment and hired me as the turnaround leader. I think the situation is getting much better. We are not making massive profits yet, but we have very good contracts with potential customers, and they are very interested in us. For me, I want to conduct good deals and show the world that we are a good company capable of growth. A company that provides high-quality products that are cost-effective. I believe this is achievable in a short period of time and I look forward to further establishing a good reputation for the company.

0 COMMENTS