In an insightful interview with The Worldfolio, Yasunari Hirata, President and CEO of Teijin Frontier, sheds light on Japan's strategic advantage in the global market, emphasizing the nation's strengths of technology amid changing geopolitical dynamics. Hirata delves into Teijin Frontier's pioneering contributions to the textile industry, highlighting the development of high-performance polyester fiber with unique properties. The conversation extends to the company's commitment to environmental sustainability, addressing issues like microfiber shedding and mass production waste. Hirata discusses Teijin Frontier's robust recycling initiatives and the challenges of constructing a recycling system. The interview also explores the group's diverse applications, including infrastructure and mobility sectors, as well as its global growth strategies and R&D centers. Hirata envisions contributing to the textile industry's development over the next three years.

Now is a pivotal time for the Japanese industry. Policies, like the US Inflation Reduction Act, are forcing corporations to diversify their supply chains for reliability and reduce country risks with nations such as China. Japan is known for its reliability and high quality. Due to the weak Japanese yen, made-in-Japan has never been so cost-effective, meaning Japan now has the opportunity to expand upon its existing global market shares. Do you agree with this sentiment? What are the advantages for Japanese companies in this current macro environment?

Now, China’s synthetic fiber production is the largest in the world, but Japan can also demonstrate its strengths in the development of high-performance fibers.

Especially, through the COVID-19 pandemic, there is a growing demand for products with high functionality such as comfort and antiviral properties, as well as environmentally friendly products, so the competitiveness of Japan's technology is increasing.

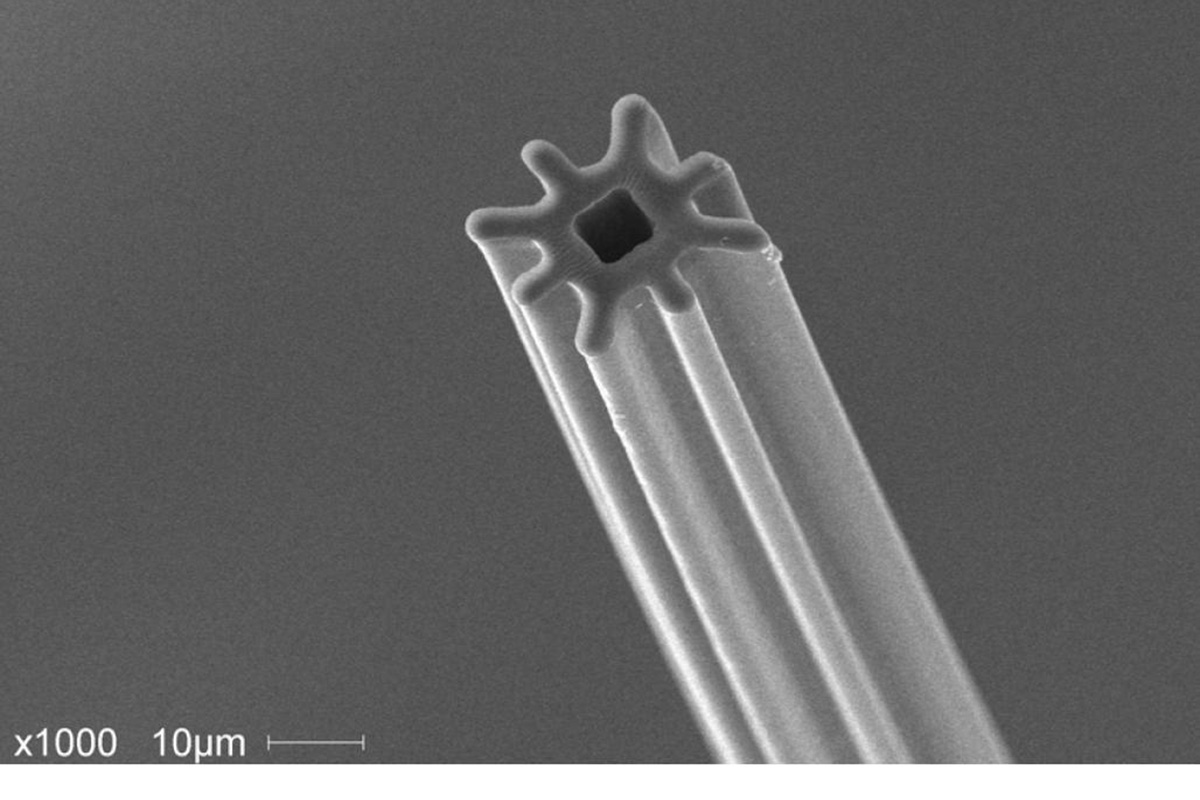

One of the key findings of Teijin Frontier is the NANOFRONT™, the world's first ultra-fine polyester fiber with a diameter of 700 nanometers or less, which is strong enough for practical use. This fiber provides conflicting functions such as water absorption and impermeability. How did you achieve a diameter of 700 nanometers or less with sufficient strength for the development of the NANOFRONT™?

While I cannot delve into specific technological details, we have developed it by precisely combining spinning technology and polymer design. These fibers pass through a variety of fabrication and processing to create various functions.

OCTA™ is a polyester fiber that features a highly deformed cross-section, with various function such as sweat absorption, quick-drying, lightweight and bulkiness.

The textile industry, specifically the fashion world and apparel companies, has received a lot of criticism in recent years from the media for its environmental footprint. Though this trend is significantly evident in fast fashion brands, it has become a generalized perception of the textile sector. How does Teijin Frontier help mitigate these environmental impacts? What eco-friendly or sustainable technologies have you developed to change the environmental impact of the textile field?

We are currently focusing on two key initiatives: short-term and long-term. Firstly, we are actively developing a textile that reduces the shedding of microfibers, which is considered to be one of the causes of marine microplastics during washing. Additionally, we are transitioning our materials to plant-derived ingredients for producing fibers and textiles to align our processes with environmentally friendly practices.

Looking toward the long term, Teijin Frontier recognizes the challenges in the Japanese supply chain within the apparel industry. The prevailing issue lies in mass volume production, leading to substantial waste. Japan’s Trading companies and apparel companies have produced large quantities of clothing in neighboring China, which is the world's factory, and, imported, and sold them, and disposed of large quantities of unsold clothing. However, We have to solve this problem going forward.

To achieve this, it may be necessary to reorganize the textile industry. Currently, many apparel companies independently supply large quantities of clothing, but just as mergers in the banking and steel industries have made it possible to improve management efficiency and provide services and products with higher added value, the integration of companies in the textile industry may also lead to the optimization of inventory and the development of more attractive products.

Teijin Frontier merged with Toho Textile in 2021. Looking at the future, are you looking for more similar mergers within or outside the Teijin Group?

While the merger within the Teijin Group can be judged by the Teijin Group, the prospect of merging with external companies remains uncertain. In any case, to break away from Japan's prevailing mass production system, I believe that a comprehensive alliance is necessary for the Japanese textile industry.

Simultaneously, the Japanese textile industry needs to establish a robust system for collecting and recycling discarded products to contribute to environmental sustainability.

We have factories for the production of polyester fiber and textiles, and we are developing a system to collect used clothing from consumers and sort materials, particularly polyester, for recycling. Effective recycling requires separating these materials since fabrics often include polyester, nylon, wool, and cotton. A collaborative effort is needed, where polyester makers recycle polyester, and cotton makers recycle cotton. Therefore, swiftly establishing a recycling system within the textile industry is essential.

Forming strategic alliances, especially with companies specializing in cotton, nylon, and wool, can pave the way for establishing a dedicated company for fiber separation. Collaboration with other industry players is essential to collectively contribute to the environment.

With your Environment Strategy “THNK ECO”, you have been actively using recycled materials and even created products like the ECOPET™. One thing we foresee in many textile companies is the slight aversion of consumers to using and purchasing recycled materials because of the misperception that they are of lower quality and are perceived as too expensive. How are you overcoming this misperception when it comes to recycled materials?

I think people don’t think that the quality of the ECOPET™ is inferior to virgin polyester. If necessary, we can also show the physical property data of ECOPET™.

On the other hand, a more problematic issue is the shortage of raw materials for ECOPET™ production. Since we utilize collected PET bottles to create pellets for fabric production, the increasing efforts by PET bottle manufacturers to recycle bottles for new production have led to a shortage in our raw material supply.

Therefore, we are also actively developing a technology to transform used clothing back into fiber.

Mass production technology has already been established, and we are currently developing technology to separate different materials other than polyester with a lower environmental impact. And we are analyzing the cost efficiency to be widely adopted in the market.

ECOPET™ is polyester products(fibers, textiles, garments, and goods) made from recycled sources: various types of polyester waste, through the mechanical or chemical recycle process.It enables the effective use of the limited natural resources.

Teijin Frontier has a wide range of applications for its products. Besides the apparel and textile industry, you also cater to the infrastructure field through certain specialized solutions and the mobility and automotive sectors. In recent times, you have expanded into the biomedical industry. Looking at the future, what do you think will be the key drivers of growth for the group? Which particular application will you focus on?

We have strategically expanded our focus on recycling in the apparel industry, with an increased emphasis on contributing to the infrastructure and mobility sectors. In the infrastructure domain, our current efforts involve the production of special fiber nets that reinforce the concrete of highways. As highways reach their 60 years of age, the deterioration of concrete has led to an increasing demand for repair and replacement work. In response, we are developing products that can effectively contribute to these critical infrastructure maintenance activities.

In the mobility sector, where various fibers are integral to car manufacturing, we play a crucial role by supplying reinforcing fibers for power transmission belts and mechanical rubber goods, noise-absorbing materials, tire cords, and fabric for car seats and airbags. Recognizing the evolving needs of the automotive industry, we anticipate future requirements for recycling car seats and airbags. We are committed to meeting these demands and supporting car manufacturers in adopting sustainable practices.

Are you also looking to partner with companies in the overseas market to achieve similar goals?

In the apparel sector, we excel in the production of textiles and garments. Historically, our garment production took place in China, but the production base has since expanded to Vietnam, Indonesia, and Myanmar. In these locations, we focus on the production of knitted goods and garments, as well as forging partnerships with suitable partners in each production base.

When will your fiber-to-fiber concept, an in-process technology, be fully operational?

We anticipate it to take about five years to achieve the fiber-to-fiber system. The establishment of our factory for mass-volume production typically takes about two to three years.

Will the factory be located in Japan?

I have yet to decide, but maybe half overseas and half in Japan.

You have R&D centers split across three countries: Japan, China, and Thailand. Many groups in the textile industry tend to have production bases in China, India, Thailand, and ASEAN countries while keeping their R&D in Japan. What are some advantages these three R&D locations bring to the Teijin Frontier Group?

We maintain multiple R&D centers for two key reasons. Firstly, the challenge is due to the scarcity of university graduates in Japan specializing in fiber-related fields. Japanese universities typically lack dedicated departments for fiber studies, and it is becoming difficult to recruit local experts in this field. Secondly, our primary production bases for yarn and fiber are in Thailand, while textile manufacturing is centered in China. With the workforce in these factories primarily comprising Thai and Chinese personnel, having R&D centers in proximity allows us to swiftly develop and recruit fiber experts from these locations. The exchange of technological information among the three R&D centers serves to enhance the overall technical competitiveness of Teijin Frontier.

As an example of this collaborative approach, Teijin Frontier's yarn is utilized in our customer’s curtain fabric. we produce yarn for curtains designed to block sunlight for this customer, and the R&D center in China evaluates the fabric manufactured from this yarn. Subsequently, our customer produces curtains in their factories in China and other countries. The R&D test center in China facilitates the evaluation process conducted by customers.

Moving forward, which countries or regions do you believe hold the key to your firm's growth? Which regions are you looking to further penetrate or establish yourself in?

While we haven’t identified specific countries and regions for future expansion, we believe Southeast Asian countries are crucial production bases. Moreover, the markets of China, Southeast Asia, and India are important in our considerations for future growth and strategic expansion.

Imagine we return three years from now and interview you again. What goals or ambitions would you like to have achieved by then?

Over the next three years, I hope to contribute to the development of the textile industry.

Although I don't have any concrete ideas yet, we want to generate enough profits to achieve our goals and continue our meaningful efforts to rebuild and revitalize the textile industry.

For more details, explore their website at http://www2.teijin-frontier.com/

0 COMMENTS