Through their runway extension and construction projects and “AIR NARITA” digitalization program, Narita is looking to reinforce and solidify their status as an Asian hub.

Since the advent of the COVID-19 pandemic, the world has seen countless global logistics disruptions stemming from rising oil prices, a lack of container availability, and geo-political events like the Shanghai lockdown or the war in Ukraine. What has been the impact of these challenges on your organization and your strategy to mitigate their effects?

The COVID-19 pandemic triggered and spread the chain reaction of the many intricate issues involved in the disruptions in the logistics sector. It began in China, where the biggest container factory was shut down, decreasing the transportation services. Some countries recuperated much quicker, such as North America and China. These areas started doing a one-way trade, resulting in an uneven distribution and shortage of containers. Due to the labor shortage and lack of human resources in harbors, cargo handling has been greatly affected. Much of this cargo was shifted to air transportation because of maritime disruption, which caused an overflow and put much pressure on air freight. This was further compounded by passenger freights being grounded which served to considerably reduce loading space and destinations. On the other hand, there have been more irregular and unscheduled flights to accommodate excess cargo. Another cause of the disruption is the limit on the airport's handling capacity of goods. Along with the pandemic, the aforementioned structural problems have posed some challenges. Based on this experience, we have to think of countermeasures to deal with and capture the growing cargo needs and growing volume of air freight.

Narita is taking the brunt of the increased air cargo shipment within Japan. Last year, it handled over 2.5 million tons of cargo, managing to function above maximum capacity. Do you believe that Narita’s handling capability is going to be sustainable in the long term? Is there a need to further develop Narita’s infrastructure to handle more air cargo in the future, or do you expect this spike to normalize?

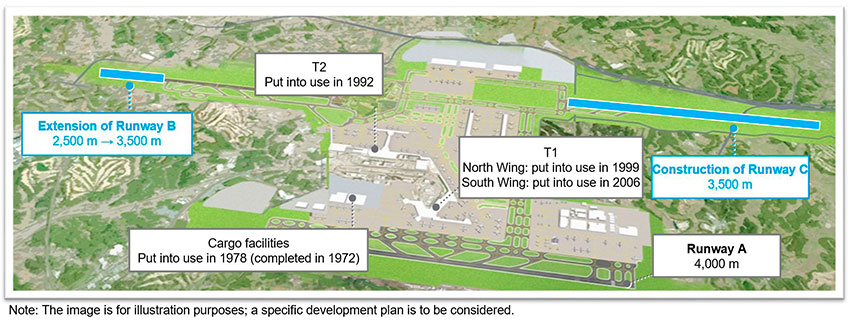

We expect it to normalize in the mid to long term, as evidenced by the recovery of the handling capacity of maritime shipping in North America and other places. Cargo shipping will return to normal. However, we have plans of expanding our capacity for cargo handling to fully capture the world's cargo demand, particularly in the Asia-Pacific region supported by its potential for economic growth. For the immediate term, we have started the construction of a new cargo facility. We also have a major capacity expansion plan to develop our third runway and our second runway extension, providing us with a larger area where we can set up a new cargo terminal. We have both medium-term and long-term projects.

What are some advantages of having the cargo-handling terminal located at the center of the airport, between the terminals?

Its closeness to the runway is an advantage, but at this moment, our cargo facilities are quite dispersed and force cargo handlers to work inefficiently. Therefore, we are hoping to centralize our facilities to maximize the efficiency of the cargo handling at Narita.

The over-reliance on China for various aspects of the supply chain has become very salient in recent times, with their zero-COVID policy and Shanghai’s lockdown that forced many manufacturing plants to shut down. Many firms are furious, especially those in North America and Europe, because of the trade dispute that has been in the background for years. When we interviewed the president of Nissin, he told us that this is a unique opportunity for Japanese hubs to take traffic away from their Chinese counterparts. Do you agree with this? What do you think needs to happen for Japan to reclaim traffic from its Asian neighbors?

Global manufacturers are redesigning their supply chain because they have come to realize their need to correct their over-dependence on China. From a logistical perspective, Japan has an advantage for its geographic location in the Asia-Pacific region. I am not sure if it will be coming from China or Southeast Asia, but the imports and exports targeting the Japanese domestic market will fall behind the global growth rate. It is crucial for Japan to widen its doors and reinforce its position as a key connecting hub in Asia for transit and transship cargo. It is a good opportunity for Japan to revive and increase its volume of logistics. However, for Japan to be an international hub and regain competitiveness in global logistics, it needs to heavily invest in enhancing the capacity of ports and hubs as well as introduce automation and cutting-edge technologies to have efficient operations. Such investment for maritime transportation would be massive and would be a challenge, but air transportation still stand a chance.

When we spoke with Mr. Morimoto of JAL, he talked about his vision for Narita and Japan, more generally, becoming a hub to connect the growing manufacturing exports from Southeast Asia to North America and Europe. Do you share this dream? What do you believe to be the strengths of Japan and Narita that would make it an ideal hub for this kind of transport?

I share that dream with him. Narita has ongoing huge expansion projects, while Haneda has some difficulties in further expansion due to their constraint in acquiring additional land and air space because of its urban location. Hence, with its location in the outskirt of the greater Tokyo area, Narita is expected to handle and increment the future demand to and from the Asia-Pacific region. That will be our strength. The Tokyo Metropolitan Area is a significantly large consumer market as well as home to some large production sites. I think combining Japan’s Origin-Destination cargo with the transshipment cargo and making the right investment in the air-cargo facilities will be the key drivers to make Narita a global hub. Compared to maritime, international aviation offers a better platform for keeping and even improving our current position.

Narita unveiled a master policy called AIR NARITA, which called for a series of topics in order to increase efficiency through DX and robotics. Ten years from now, how do you expect these digital technologies and robotics to transform Narita Airport?

Without the introduction of new technologies, we cannot maintain and increase our competitiveness. “AIR” stands for Activate, Innovate and Renovate. Narita is lagging behind when it comes to digitalization, so we need to take steps to catch up with the top running overseas airports. Important information is shared among our stakeholders but digital connectivity is still limited. We need to improve the efficiency of our collaborative decision-making through the digital linkage of our database with proper security. Through the total airport management system that we are planning to introduce, we can digitally share information in a timely manner to help our stakeholders decide cooperatively. This will steer us forward in the right direction. Our aim is to introduce and improve the total airport management system through our projects.

Your company has set a target to reduce CO2 emissions both overall and from each individual flight coming in and out of Narita by 30% by the end of this decade. Could you share with us your roadmap and some of your initiatives to reduce your carbon footprint? Do you believe that 2050 is a realistic target for this sector to become fully carbon-neutral?

It depends on technological advancement and innovation. I truly believe that we can achieve the goal of 100% carbon-neutrality through zero-carbon emissions without relying on purchasing carbon credit by 2050. In the coming decades, we will be introducing sustainable aviation fuel, which would reduce CO2 emissions by 70%. The overall contribution ratio of cutting CO2 emissions at the airport through efforts made at the terminal is only about 10%, while 70% comes from aircraft. Replacing the fuel with sustainable aviation fuel is critical. Later on, when hydrogen or electric aircrafts come out and increase in numbers, we can gradually move on to achieve true zero emissions.

We will start zero-emission buildings for our terminals and replace the energy source with sustainable renewable energy. Our plan is to take the opportunity to introduce a new system that reduces carbon emissions when we renovate our supply system.

What do you see as being the main obstacle to the adoption of sustainable fuels?

The two major issues are the price and the absence of domestic manufacturers for the new source of energy (SAF). Nevertheless, the Japanese government is now taking the lead in establishing and increasing domestic SAF production,

which is hoped to lower the procurement cost of SAF.

The conventional jet fuel engine is transported through a 47-kilometer pipeline from Chiba port to Narita. Once we obtain sustainable aviation fuel (SAF) and get it to the port, we can utilize our existing pipeline and infrastructure. Also, Chiba port can accommodate large tanker ships. With some modifications, Narita Airport can reconfigure to store and serve SAF, but the problem is the price. Learning from overseas, it is important for the government to grant subsidies, and the airports and airlines must share the costs. The cost may seem extreme in the introduction phase; however, with penetration, the price will gradually decrease. All the parties have to actively exert effort.

You carry out overseas airport projects, comprising of surveying, management & consulting services, which has become the latest pillar of your business operation. What is the background or some of the motivation to bring your expertise in airport management overseas?

Narita Airport has a long-standing experience in working together with the Japanese government to provide international support and aid to developing countries. We have dispatched our engineers to help in the operation and construction of numerous overseas airports.

Around 2010, Japan's government started to push forward the participation of Japanese companies in overseas infrastructure projects. In 2018, the enactment of legislation supporting the overseas expansion of the private sector has enabled us to be involved in overseas infrastructure projects, which require investment. This overseas business has become one of the pillars of our strategic growth. One of our first projects was the Mongolian Airport in Ulaanbaatar. We are aware that there are major operators who are active in overseas airport projects. While we have been involved in overseas projects in terms of international cooperation and support, we lack experience in engaging projects as a business. As a newcomer in the market, we must strengthen our structure and deliver quality work to accumulate experience.

Do you have upcoming new projects? What regions or countries do you think have the most potential?

As there are many upcoming projects, we need to research and determine projects to participate in. The Asia Pacific is the region where the strength of Japan will be best applied. Our approach as a newcomer and a latecomer to compete with major operators is to collaborate with domestic entities such as trading, consulting or real estate firms.

As you compare yourself to some competitors and potential competitors in the field, what would you say are some of the advantages that your background as an actual airport operator with a massive capacity brings you?

We have a long history of being a total airport operator, and we have expertise in managing both landside and airside. Compared to smaller airports, we handle large passenger and cargo capacity, which can be counted as our strength. However, international business is very difficult because we are required to send our experts with good language ability. The demand for a very high level of expertise makes the competition tough. I think we need to put forth much more effort.

There will be some projects in the future to accumulate more experience and know-how. Our ongoing major projects at our airport can be likewise transferred to other countries. The challenge is not only to build very large airports but also to introduce state-of-the-art technologies. If we can achieve that, we can export those successes overseas, especially to developing countries.

Through new projects, our engineers can upgrade and acquire new knowledge, which cannot be obtained just by doing maintenance at Narita.

Imagine we come back to interview you again on the last day of your presidency. What objective or ambition would you like to have achieved during your time as president?

The building of our third runway and the extension of our second runway triggered our other activities. The renovation of the passenger and cargo terminal needs to be done. Rehabilitating the energy supply system for achieving a reduction in our carbon emission is another upcoming activity that we want to fulfill. In addition to that, we want to incorporate cutting-edge automation, robotics and digital technologies. We want to take and contribute our experience to overseas countries. When you come back on my last day as president, I hope to be able to say that all of these projects are positively moving forward.

0 COMMENTS