EcoCycle Corporation has developed a comprehensive approach with a key strategy of ‘in-situ remediation’ – which has revolutionized the process of cleaning soil and groundwater contaminated with toxic chemicals.

If we could start the interview with a brief introduction to yourself. What is your background, what led you to end up in Japan, and what led you to EcoCycle as a company?

I was a researcher at a university in India working as an agricultural microbiologist. During my days there I specialized in microbes for the betterment of crops. At Chiba University there was a professor who was working on similar projects. I thought I could come here for research. I was able to receive a Monbusho scholarship so I made my way to Chiba University.

At the time I met the president of EcoCycle who had just founded the company, and the company was making zero revenue. He asked me if they could utilize my knowledge in microbiology to develop some products that were centered around recycling. At the time the semiconductor industry in Japan was booming and there was a lot of toxic waste coming out, and honestly, dealing with that toxic waste was difficult. The initial idea was to recycle some of the industrial effluents like organic solvents. Those solvents were quite costly at that time, so recycling meant good things for the environment and for the industry. We initially started with recycling but later we found that the prices of those solvents started coming down, so it means that buying new solvents would be cheaper for the manufacturers. Honestly, that was a major problem, and at the same time because I was a soil microbiologist I started working on the decontamination of soil.

As I mentioned, the company was generating nothing in terms of revenue. The first patent I received would be on a product that stimulates native microorganisms in the soil that can degrade some of the toxic compounds in contaminated soil. We were funded by the Toyama local government. That was a big break because at the time biodegradation; using the power of nature to degrade, was not that popular in Japan. We were a pioneer in this field, although many large companies had tried in the past and failed. The thought was that microorganisms really can’t degrade these toxic compounds because they are carcinogens and are just too toxic. I was the first person in Japan to successfully develop a product that shows in the field that microorganisms could be very effective in degrading chlorinated solvents. That was the start of our journey, and although the patent was achieved, the way at the time was to dig the soil and then treat it; a very costly process. The difference between the costs of the traditional way and my way however was over five times. A project that might cost USD 5 million traditionally, I could do for USD 1 million. They had another method they could use, which involved extracting the groundwater, but that process would take over 20 years, but I could achieve the same results in less than a year.

Since then our firm has been a pioneer in bioremediation, and up till today in Japan, we have completed hundreds of projects. We have manufactured the products and supplied them to the general contractors (GC) who can implement projects. I realized early on that with just a product you cannot accomplish a task; you need a lot of engineering behind it. I used to teach that engineering aspect, but ultimately, I thought that I should just do the engineering part. We as a firm started taking on projects and implementing the cleaning, and I think today we stand before you as a total solution for soil and groundwater.

It is our view that Japan is at a very exciting time for manufacturing. On one hand, we have had major supply chain disruptions in the last three years, caused by the COVID-19 pandemic as well as tension from the China-US decoupling situation. As a result, we are seeing many multinational groups try to diversify their supply chains with a focus on reliability. This is where Japan can enter; a country known for decades of high reliability, trustworthiness, and short lead times when it comes to production. Now, with a depreciated JPY, it is our view that there’s never been a more opportune moment for Japanese manufacturers to meet the pressing needs of this macroeconomic environment. Do you agree with this premise, and why or why not? What do you believe to be the advantages of Japanese firms in this economic environment?

I will give you a figure of 20 trillion Yen and I would like you to think what that number is exactly. It is the trade deficit of Japan last year. This is a huge figure now as the JPY is hitting some historical lows. If Japan is gaining by having this low exchange rate then we would not have such a huge trade deficit. We have seen 20 months of consecutive deficits, and in August 2023 when we are recording this interview, yet again we are seeing a deficit. What does it mean? Well, you have to look at both the macro and micro environment here. Some of the manufacturers are seeing some benefits in terms of exporting things such as electronics and automobiles. However, as a nation, there are no benefits and the country is running on artificial growth.

Well, you might then ask, “Why is the JPY weak and why is the USD strong?” The American interest rates are high, but in a year or two they will start reducing the rate. That means that any slight advantage you had with the weak JPY will be lost almost immediately.

Having a weak JPY and a big trade deficit means that Japanese people are paying a lot of money for energy. The government is trying to keep those energy prices low in Japan, but they are doing so with taxpayers' money. The weaker JPY is not really helping and the Bank of Japan has kept rates at historic lows. I think the question now is, “How long can they keep it low?” Once inflation really starts kicking in here you really can’t keep it that low. The salaries of Japanese employees are some of the lowest in the world right now among advanced countries. All of these factors combine to create a situation where the competitive edge that Japan once had decades ago is almost completely gone.

The amount of borrowed money in Japan is ballooning, and it can’t keep going at this rate. The country has borrowed so much money and that is going up and up because of artificial growth. The government is not allowing companies to compete at an international level.

The pressuring issues of Japan’s changing demographics are creating several issues domestically, those being a labor crisis and a shrinking domestic market to sell products to. How much do you believe Japanese firms need to move overseas to overcome this labor force shortage? How can firms like yours navigate these issues and ensure the long-term sustainability of your business?

Since the end of WWII Japan has been built as a country based on technological innovations. Companies like Toyota, Honda, and Sony have built on existing technology, but beaten American companies to iterate and improve on technological breakthroughs. Back when Japan rebuilt after the ashes of WWII, these types of companies rose off the spirit of young people who were determined to achieve success.

Unfortunately, nowadays the population is decreasing and fewer students are opting for research positions. It means that a majority of students want to get employment as soon as they graduate from university, and now that jobs are plentiful, the sense of competitiveness is gone. There is no point in taking research positions because they feel a job is already there for them. The fire that was in the heart of many young entrepreneurs post-WWII is also gone. It also means that in the next 20-30 years Japan’s biggest concerns are going to implode. This isn’t because of China or North Korea, but internal threats.

Developed countries need young brains who have the drive to innovate, and I think that a big concern is that the Japanese government simply does not understand how grave a threat this demographic issue is. They must change their policy entirely. If you want to build a country, you can’t do it with the artificial growth they are using right now. Japan is a country that lacks natural resources, so in the past, it has relied on the knowledge and expertise many people here have, but over the years the working environment to promote the raising of families has been severely ignored. Honestly, over half the population has been ignored for decades, and then they wonder why women have to choose between a career or a family. The mistakes of the past are now coming back to haunt many Japanese companies.

I think another key aspect lies in the universities which are not providing courses in English. It means that these universities are ignoring talent that is waiting outside of Japan for opportunities. Look at companies like Alphabet, whose CEO, Mr. Sundar Pichai, is Indian. If the talented people spoke Japanese only, they would not go to the US. These days English has become such a universal language and has become a unifying force. Japan needs more policies to allow foreigners into the country, and if you have a university course in English you can attract some of the best talent in the world. Those who come would then learn that Japan is a good place to make a living. Instead, foreigners tend to only stay in Japan for a few years and then return to their home country.

In the case of your firm are you actively looking for foreign staff?

I think the biggest problem in terms of hiring foreign staff is the Japanese language. All of our clients speak Japanese, but it is a reality of our company. Post Corona as we are giving additional thoughts on expanding on an international level, recruiting foreign engineers might be key.

Due to the high levels of tectonic activity, Japanese soil is known to be a lot more complex than soil you might find in Europe or the US. This makes building projects much more complicated and contamination projects are much more difficult. If we look further afield, we see a similar situation with countries around the Pacific Ring of Fire such as Indonesia, Malaysia, and Papua New Guinea. All these countries that are susceptible to natural disasters tend to have similar soil composition. Can you talk about the advantage that firms like yours have in this industry when conducting overseas projects when compared to European or Chinese-based firms? Are Japanese firms best suited to overseas projects because of their experience with the domestic soil composition?

I think if you are a skilled engineer you take the soil composition into account the minute you are assigned a project. We have many different technologies and there is no company in Asia with such a mix of different technologies. The major strength we have is that we can offer total solutions to clients, and that means from site investigation all the way to remedy application. Just with remedies alone, we have so many different technologies we can apply in any given situation; things such as soil containment, soil washing, and soil flushing. We are the only company that can offer clients the entire spectrum of solutions to meet their needs.

Former Prime Minister Suga announced in 2020 that Japan has set targets for carbon neutrality by 2050. How is EcoCycle helping clients in Japan and overseas reach their carbon neutrality targets?

As I explained earlier, typical companies deal with soil contamination by digging up the soil and cleaning it, basically just treating the soil somewhere else. If you were to compare the numbers between our Carbon emissions and typical emissions you would see a big difference. At a contamination site, there are microorganisms and all we do is stimulate them. Essentially, we increase the naturally occurring microorganisms and they eat the contaminates, so it means that our method is very environmentally friendly. We are utilizing the natural energy of the soil to remove the contaminations.

Other companies will use large vehicles such as excavators to dig the site, all of which emit large amounts of CO2 into the environment. If you were to go to our sites you would see nothing like this. In our sites, you will see numerous small holes in the ground where we inject nutrients. The nutrients stimulate the microbes which then increase in population and eat up all the toxins. No noise, no CO2, nothing.

What are your thoughts on the recent decision to release contaminated water from the Fukushima disaster of 2011?

There are two aspects to my thoughts on the matter. The first is the fact that any industry in the world has some sort of effluents that come as a result of treatment. Each of those has an environmental standard. It is not just Fukushima; all industries are releasing different chemicals and there are standards that set what is safe to release and what is not. What they are releasing is much lower than the Japanese standard and the World Health Organization (WHO) standards. I actually don’t understand why China is so upset about this because their own standards are actually much higher than what was released, so their own scientists have proven that this water is safe to release. I think at this point we all understand that the drama is politically motivated rather than scientific.

In Japanese we actually have two diametrically aligned words; anzen and anshin. Both mean the feeling of “being safe,” but anzen is objective and anshin is subjective. Anzen is purely based on science, whereas anshin is an opinion, so it means that anzen isn’t always anshin. You can say that something is safe and meets standards, but that doesn’t necessarily mean that the public will feel safe about something. In Japan, you need to address both anzen and anshin by making sure something is safe and then using data to ensure that the public feels safe about it.

Your company has 3 key divisions, those being sustainable materials, environmental preservation, and water treatment technologies. Out of these 3 divisions, which do you believe has the best potential for future growth long-term?

I think that they are all connected in some way. At the end of the day the earth is one big planet and everything is connected. Water is the key here, and I think that future wars will not be fought over petroleum, they will be fought over water. It means that water is very precious and even countries like Japan have droughts. Niigata is somewhere that in August 2023 should have a lot of rain and snow, and the region is very famous for its rice. Right now Niigata is experiencing a drought. I think EcoCycle will be very focused on water in the not-so-distant future.

Could you tell us more about this in-situ remediation technology?

It might be worthwhile to talk a bit broadly first before diving into the in-situ remediation technology. Like many developed countries, Japan has several factories, and in fact, Japan is famous for its manufacture of automobiles, electronics, heavy machinery, and steel. You take any of these industries and you will see the use of chemicals for manufacturing or services. Over a period of time, these chemicals reach the soil and water, thus contamination occurs. If those contaminates reach a potential water source such as a well, then you have a problem because contaminates have now reached the human food cycle. It can cause all sorts of diseases.

In Japan, we have regulations that dictate that we must clean up these kinds of things, and for that, our company has different technologies. As I mentioned earlier, most of the time Japanese companies have been implementing a dig and dispose approach. It is a method that has been employed for a long time now. Not only is it slow, but it is also costly to companies.

What we have been doing is called in-situ remediation. What this means is that we don’t take the contamination out somewhere and clean it, instead, we degrade that contamination at the site without removal. I think the fact that we can do the cleaning at the site is a huge advantage. In fact, it allows firms to continue their production and they can conduct business as usual. It is cheap, environmentally friendly, and very quick.

Now, thanks to the reason I’ve told you, we are seeing in-situ remediation becoming very popular in Japan right now. We have sites from Hokkaido to Kyushu, and most of our clients are factories or real estate developers.

I’ve talked about a few products today that all follow bioremediation principles, and honestly, it has been a major strength of our company and myself personally. Most sites we visit involve cleaning solvents as they have been widely used around Japan for decades. I would hazard a guess that around 40% of sites require us to clean solvents of some type. It explains why our major product of the EDC line is used to clean solvents.

Very early in your company’s history, you completed numerous overseas projects, roughly around 2006 with projects in America and India if I’m not mistaken. These locations are very far afield, especially in terms of locations to do a company’s first overseas projects. Could you tell us the story behind them?

We wanted to expand our business so we went to both America and India for a period of time. In later years because of the projects we implemented, we became quite busy in Japan. At that point, there was no need for us to go outside to foreign countries since we had so much work domestically. Additionally, those three years of COVID totally stalled our international business. We will eventually do more business outside of Japan, but right now we just have too many projects inside.

What we are doing right now is helping Japanese companies that have sites outside of the domestic market. I can’t name specific companies due to non-disclosure agreements but think of a large air-conditioner maker. This Japanese maker had a site in Brazil so we went there and cleaned it. We also have a project with a large paper manufacturer in Japan that has a site in India, and the plan is to clean that site too.

A large obstacle we face is actually the type of business we do. In foreign markets, we are not manufacturing things like cars or electronics. Instead, what we do relates to environmental issues. These things are driven by governmental approval and some nations have stricter regulations than others. Unfortunately, countries like India don’t even have regulations on groundwater and soil contamination. It means that although there is a lot of contamination, nothing can be cleaned with prior regulations set. Essentially you have a rule that says whoever contaminates it cleans it. Nobody is taking any responsibility, and that is a big problem.

Slowly things are changing, however, and places like Taiwan are now using our products through a subcontract agreement. In fact, I would go as far as to say that Taiwan is a major market for us now.

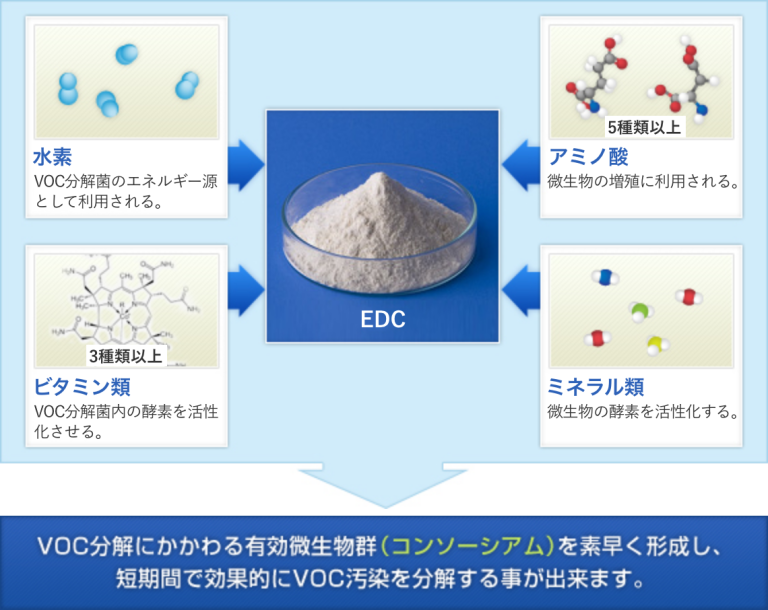

You mentioned here how regulations can impede development, and you gave an example of how through an agent-like product you were able to enter new markets. During our research, we saw some interesting agents you offer such as your EDC, a bio purifier that uses microorganisms to decompose and remove volatile organic compounds. In fact, for certain bio-agents, you hold the number one market share here in Japan. Can you speak a bit about your agents and how you’ve been able to gather such a large market share?

EDC series and HAR series are our proprietary bioremedaiton products, which are basically the nutrients for soil microbes. We inject these products into the soil to stimulate native microbes that eat on contaminants. I would say that this product has had the best performance for us so far. We actually have a number of different products for all sorts of different applications, because as I explained earlier, we are a total solution provider.

EDC is effective for silt clay soils and coastal areas, covering a wide range of different industries. Then we have EDC-M which is nutrients for microbes that respire hexavalent chromium. As you might know, carcinogens can stay around for hundreds of years if not dealt with, but with our products, we can actually clean it within a few months, and the amazing thing about our products is the fact that there is no residue. The contaminants are gone, degraded, and reduced to water and CO2.

You spoke there about EDC-M as an industry-specific solution for the electroplating industry. Are you currently looking for partners in certain industries domestically or overseas that could help you develop new products to match specific industry needs?

Right now we do have very good partners and for each country where we have a presence we try to search out for partners. Normally we are looking for local engineering firms because not everyone can understand the technical language we are using. Regulations in each country are different so we can provide technology to local partners and they can conduct the site cleaning to meet the specific regulations of that country. We actually bring engineers here to train them how to clean a site. We sell the products and whenever a project comes up we give them the design so that they know exactly what they are doing.

In Taiwan, we have a partnership with a local engineering company that is implementing our products. In India, we are working with a large consultancy firm that is helping with projects in the region.

In 2019 you became a consolidated subsidiary of ORIX Corporation, a diversified financial services group. Reflecting on the past four years, what have been the biggest synergies and the biggest strengths you’ve seen from this integration?

That was a huge boost for us in many ways. I personally am an innovator and as a whole, we are a technology company, so here we have engineers and scientists. We don’t have business people. EcoCycle was not known much in Japan, whereas ORIX is a financial services group that operates globally. They have business people, in fact, I believe they have over 400 marketing staff alone. They have branches from Hokkaido to Okinawa, so that kind of marketing network alone is something incredible that we can leverage. What they have achieved in terms of reach is something that we simply could never develop.

I think the second key aspect here is that ORIX is a brand that many businesses know. Most of our clients are either major real estate developers or manufacturers. It is difficult for us to go to those companies and explain our products. If ORIX is there they can do that because they already have an established relationship with those companies.

Japanese companies excel at R&D, with Japanese companies in general spending 3% of the annual GDP on R&D and China on the other hand spending 2% as well as the US spending only 0.5%. What is your current focus in terms of your R&D strategy? Do you have any new products that you would like to share with us today?

Since we partnered with ORIX, we have started getting a lot of projects from real estate developers. These real estate developers don’t have much time since once they buy a property, they need to turn it around quickly. If a property has some sort of contamination, they want it dealt with so that they can begin their work. Real estate property prices are on the rise in Japan and therefore decontamination can be a very high burden. They are looking for cheap technology that is also very fast. We are working on integrated remediation technology, which takes an integrated approach. It has helped us minimize the span of time needed to complete the decontamination process, while at the same time being very cost-effective for clients. While usually this process takes around one year, with this new product we are able to complete the decontamination process in 3-6 months. Additionally, the cost will be around one-fifth of the traditional cost of digging and disposing.

Have you heard of any similar firms in Europe conducting soil remediation?

There are large environmental firms all across Europe, but if you are asking if there is a firm that is so focused on soil remediation in the same way we are, I don’t think they exist. There are a few in the US but it is still quite niche.

I will say that in Europe there are a number of car manufacturers so the use of chemicals is prevalent. That means there are sites with contamination, meaning that there are opportunities for our firm.

As you mentioned, your company was founded in 1999, so if we fast forward to 2029, your company will be celebrating its 30th anniversary. Imagine that we come back then and have this interview all over again. What goals or ambitions do you have as a president that you hope to achieve by then?

Right now in terms of technology, I feel that we are number one in Asia in the field, but I personally would like to also be number one in terms of presence. COVID-19 really stopped us from going overseas. Thailand, China, and India are the places we want to expand to.

The second goal I would like to achieve is to show real estate firms in Japan that they don’t need to dig and dispose of soil in order to decontaminate a site. I want to show them that green technology does exist and that we can offer them products that can clean toxic compounds.

0 COMMENTS