Insights into Japan's construction industry, the role of Chodai, and their pursuit of innovation, safety, and sustainability for infrastructure development amidst demographic shifts and emerging challenges.

Japan's last construction boom occurred more than 50 years ago, prior to the 1964 Olympics. Since then, due to Japan’s demographic shift, on the one hand, there is an increasing demand for maintenance, while on the other, there is less need for new construction projects. What are your thoughts on the current state of the Japanese construction sector?

As you mentioned, with Japan's aging population and declining birth rate, there is a growing need for the upkeep and maintenance of existing buildings rather than constructing new ones or developing infrastructure. Currently, our business ratio has shifted to a 50-50 split, with 50% dedicated to new construction and 50% to the maintenance of existing structures. The percentage for maintenance is expected to increase in the future.

Speaking about the national Japanese government budget for public infrastructure, there are numerous emerging issues that require funding, including the rising healthcare costs associated with an aging population and the increasing tension in regional countries like Taiwan and China. This has led to a need for an increased self-defence budget. Due to these factors, we do not anticipate a significant increase in spending on social infrastructure and construction since it is an area where budget cuts are possible. However, it is crucial to prioritize the maintenance of existing infrastructure for safety, so there will still be a certain percentage of the budget allocated to that.

The construction sector, like many others, is facing a shortage of young workers, and the older generation comprises a significant portion of the workforce, with one in four workers over the age of 65. What are some challenges and opportunities that this demographic shift presents for your company?

Currently, our company has not experienced any major impact in terms of hiring both new graduates and experienced personnel. However, we acknowledge the potential risks in the near future. It is essential for us to consider how we can automate processes, introduce IT and digital solutions, and increase operational efficiency to mitigate these challenges.

Chodai combines advanced ICT, such as IoT and AI computing, with your accumulated infrastructure technology. How do you plan on implementing these innovative technologies into your services?

Currently, we have developed robotics technology for analyzing and assessing the condition of cable-stayed bridge cables. We are working on modifying this technology to be applicable to suspension bridges. The technology's name “Vespinae” is derived from the buzzing sound of bees because it has a similar sound.

One of the biggest challenges we encountered during the development was maintaining the robot's orientation while running on the cable. Since the robot takes photos using a monitor, it needs to stay in the same position. To address this issue, we collaborated with a university to develop technology that ensures the robot remains stable, even in the presence of wind or airflow from propellers.

There is an 80% chance that a major earthquake will occur within the next 30 years here in Japan. We know Chodai extends the lifespan of aging infrastructure through scientific verification and research. Could you elaborate more on how your efforts help ensure the safety of infrastructure in the event of a significant earthquake? Do you believe that Japan’s infrastructure, like its bridges and roads, is prepared to handle such a substantial earthquake in the future?

Chodai has extensive experience and involvement in the construction of bridges and infrastructure, such as roads, in Japan. The Japanese government has set high standards for construction to ensure earthquake resistance, especially after the Great Hanshin and Awaji earthquakes. Both newly constructed and retrofitted bridges and roads meet these strict regulations. Therefore, in the event of another major earthquake on the scale of the previous ones, Japanese bridges and roads can still endure and function effectively. I have no concerns about their ability to withstand such earthquakes. However, the major concern lies with the possibility of landslides occurring during earthquakes, which could block roads or bridges. Landslides cannot be prevented due to the complex contours of the land. Looking at recent earthquake experiences, like the Niigata-Chuetsu-Oki earthquake or the earthquakes in Hokkaido, and Hiroshima, landslides have been the primary cause of damage. It is challenging to prevent landslides proactively since measures can only be taken based on past cases and lessons learned. This knowledge can then be applied to similar geographic areas to mitigate the risks associated with landslides.

There are earthquake-prone countries around the Ring of Fire. Is it an area of interest to help provide your technical expertise to these countries in earthquake-prone areas?

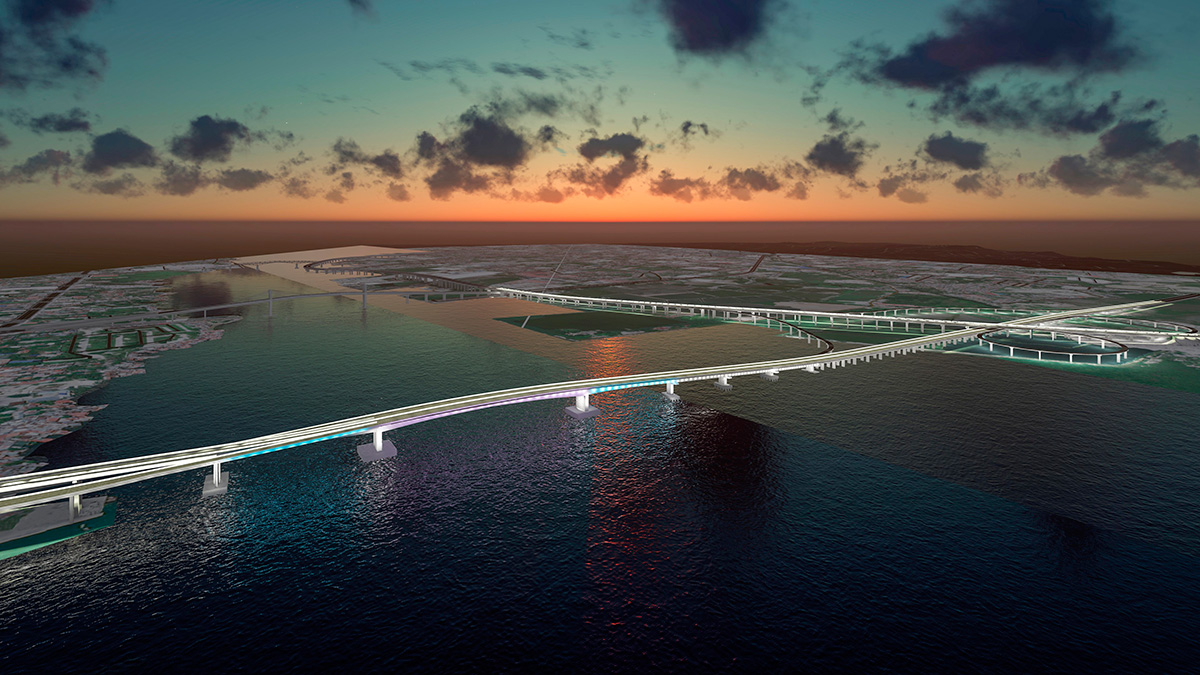

We have already been active in the overseas market. For instance, we have a subsidiary in the Philippines and have been involved in projects in Turkey, including in Izmit, and the third Bosphorus bridge. You always have to consider the needs and requests of those specific localities. Additionally, economic factors and feasibility need to be considered. Currently, our focus is on Indonesia, where we have a local subsidiary and partner. Indonesia is currently prioritizing new construction projects, but in the future, high-maintenance solutions will likely be required, and we will be well-positioned to assist in that regard.

Izmit Bay Bridge

The transportation landscape is undergoing significant changes with the installation of electric charging stations and the advancement of autonomous driving technology. The auto industry’s objective to reach level 5 driving autonomy is transforming how people use their cars, as well as how traffic is regulated. As a company involved in developing new road environments, how do you anticipate roads and highways evolving in the next 10 to 15 years?

When it comes to autonomous driving, achieving levels 4 and 5 on highways would be relatively easier due to the straightforward nature of highway driving between intersections. However, local roads in Japan are often convoluted and narrow, still requiring driver’s support to their driving at autonomous driving level 2 or 3. Finding the right balance between autonomous and manual driving will be a challenge in the future.

You are currently working on system design, take-off, and landing site design for flying cars, utilizing your infrastructure technology. Can you tell us a little bit more about the project and some of the difficulties you have faced so far?

There is a significant move towards realizing flying cars, and we are actively involved in standardizing the takeoff and landing sites. We have been working closely with the national government to establish these standards, and the overall framework was completed this March. Building upon this framework, additional systems and standards will be developed to fully enable the realization of flying cars. The Japanese government is leading this initiative and plays a crucial role in providing approvals. Collaboration and partnership between the government and private entities are of utmost importance.

The Osaka Expo will serve as a starting point for the introduction of flying cars, and it will undoubtedly provide a significant push for further advancements. For the Expo, the flying cars will operate between the landing and takeoff sites and the expo venue. However, the vision is to expand the transportation network to nearby airports such as Kansai or Kobe Airport, even flying over the sea. While there are still challenges to overcome, utilizing expressways for over-flying car travel is seen as a viable option.

In addition to your work with road and mobility infrastructure, you also have operations when it comes to renewables, providing consulting for power generation facilities such as electric, solar, wind and biomass. Can you outline your renewable energy business and the potential you see in it?

Our renewable energy operations began with small-scale hydropower generation projects in the Philippines, specifically in Mindanao. We are currently working on introducing the second and third-generation units. However, negotiations with local communities have presented some challenges. Once these issues are resolved, the second and third projects will move forward. Additionally, we have a biomass generation plant in Yamanashi, in Nanbu town, which has attracted significant attention. We receive numerous visitors interested in the plant, and we hope to expand this initiative domestically.

As for solar panels and systems, the domestic costs make them financially unviable. Therefore, we are collaborating with a Taiwanese company to undertake a project in Taiwan. Once we establish a successful model, we plan to expand to other Southeast Asian countries. Our renewable energy operations not only focus on environmental sustainability but also aim to contribute to the local community. We work with local companies and individuals, involving them in the projects. For example, in our biomass project, we collaborate with local companies and source thinned wood from forestry operators in the area. In the Mindanao projects, we hire locals, ensuring a benefit to the local community.

Cebu-Mactan Bridge and Coastal Road Construction Project

You have also been involved in the Super Village project with Sarabetsu Town, which is a digital smart city idea. Can you provide more details about the Super Village project and how you got involved?

The government has taken the lead in the initiative for the Super Village. We sent letters to multiple local villages and towns across Japan to gauge their interest in participating in this project, and Sarabetsu Town raised their hand. Consequently, we have begun collaborating with them and the national government to realize a smart city as part of the government's strategy for digital smart city planning. This project was initiated last year, and Sarabetsu Town is facing challenges related to an aging population. We are introducing smart city solutions to enhance their quality of life. As part of this initiative, we lease smartphones to residents, provide training on their usage, and facilitate various services through the smartphone interface.

For instance, residents can use their smartphones to call taxis on demand, and we have implemented autonomous delivery services within the town. Additionally, numerous events are organized, and smartphone applications serve as a means of participation. Starting this year, we are also introducing a cashless scheme through a partnership with one of our collaborating companies.

Are you looking to find similar collaborative opportunities in towns or locations worldwide that are facing similar issues?

Currently, our focus is solely on Japan. There are ample opportunities for applications within the domestic market, allowing us to learn from the experiences of Sarabetsu Town and apply them effectively. Moreover, developed Asian countries have their own consultants and methods for introducing smart cities. Sending our resources overseas for such projects is not practically feasible. Therefore, our current focus remains on Japan.

Imagine repeating this interview in another five years: what goals would you like to have achieved by then?

We are currently promoting a long-term vision for 2030. Achieving this vision is a key priority during my presidency, focusing on sales targets, human resources, and continuing M&A activity, which are vital strategies for our company's operations.

Last year, we acquired PC Railway, a local consultant based in Tochigi. Establishing a presence throughout Japan is crucial, particularly for effectively responding to the country's frequent disasters, as you mentioned. While it may not be feasible to achieve this goal by the 60th anniversary, our aspiration is to have a presence in all prefectures of Japan through M&A activities and our own efforts. That is the goal we have set for the future.

Interview conducted by Karune Walker & Sasha Lauture

0 COMMENTS