Ray's RAYFace technology is reshaping dental and medical practices worldwide, with a particular focus on expansion in Europe and the United States. Targeting top-tier implant surgeons and prioritizing practitioner profitability and patient comfort, Ray has gained significant traction in key European markets.

South Korea currently faces a unique demographic situation. On top of becoming the world’s first country to see its fertility rate fall below 1.0, experts estimate that by 2025, more than 25% of the South Korean population will be over the age of 65, turning the nation into one of the first super-aging societies in the world. While this demographic trend presents challenges, it also provides the Korean medical sector with a unique opportunity. How does it impact lifelong dentistry?

I believe there is a growing need for dental treatment, especially with an aging population. In the past, the focus was primarily on necessary treatments. However, with increasing lifespans, there is a shifting emphasis towards the aesthetic aspect.

Traditionally in Korea, teenagers and young children would undergo orthodontic procedures like braces, and older individuals didn't perceive the need for such treatments, assuming they had relatively few years left. Consequently, they prioritized essential dental care, minimizing expenditures on aesthetics. However, due to longer lifespans, even individuals in their 50s and 60s are now seeking clinics for aesthetic purposes, including braces and laminate treatments. This marks a significant shift. Furthermore, with the rise in Koreans' income levels, there is an increased willingness to invest in dental aesthetics. I anticipate that the dental aesthetics sector will continue to expand in the future.

In 2021, the market size of the medical device market in South Korea reached 9.1 trillion KRW. However, critics such as Professor Sun Kyong of Kyung Hee University claim that this increase has mainly contributed to foreign companies, not domestic ones. How do you anticipate this trend evolving?

If we examine the current medical market, it is dominated by numerous multinational companies. Additionally, major hospitals and university hospitals often prefer products from large global companies, posing a challenge for domestic players to enter and expand their market share. I believe this trend will persist in the future. However, the landscape differs in private practices. They actively utilize local products, fostering mutual growth with domestic companies and leading to increased exports for local players. Notably, private clinics hold a substantial market share in the entire medical sector, especially in the fields of plastic surgery, dermatology, and dentistry. This is why I anticipate that dental and aesthetic companies will successfully penetrate the global market, driven by their growth in the domestic market.

Korea's growth in the medical aesthetics and dental field is a noteworthy phenomenon. What is particularly intriguing is that this growth has occurred despite the generally conservative nature of dentists and medical institutions. Changing suppliers or adopting new technologies for medical procedures poses a considerable challenge for new products and companies. As a firm that has already established itself, what do you believe are the key drivers to surmount this barrier? To what extent can we attribute this challenge to a matter of reputation versus a matter of technology?

The medical sector itself is inherently conservative. However, one clear reason explains the increase in the use of domestic products in private clinics, surpassing imported alternatives. Despite similar efficacy, domestic products prove to be more economical. The technological levels between Korean and imported products are already quite comparable, but the latter tend to come with a hefty price tag. For private practices, Return on Investment (ROI) is a crucial factor. Maximizing profits with the same investment becomes a priority. Therefore, private clinics find it more economical to utilize affordable domestic devices and equipment with equivalent efficacy, enabling them to garner more profit with a lower investment. The primary focus is on products that can generate the most revenue, and this financial consideration appears to be the primary motivator for hospitals to adopt new medical devices, even in light of their conservative tendencies.

As an example, dental implants were not widespread in Korea initially, with only a few hospitals offering such procedures. However, as clinics began reaping significant profits from implant surgeries, more hospitals started to perform them. This led to the development of affordable implant products by Korean companies, creating a competitive market that further reduced prices. Presently, over 95% of dental clinics in Korea perform implant surgery, a significant shift from the past focus on bridges and dentures. Similarly, in the skincare aesthetics market, dermatologists found substantial revenue streams through skincare products. This prompted hospitals and clinics to purchase skincare products, resulting in the establishment of numerous local skincare companies. The pivotal factor here lies in companies devising strategies for hospitals to maximize their profits.

For clinics and dentists, the implementation of modern procedures necessitates practitioners and clinics to comprehend these new practices and receive direct feedback from the specialized community. At Ray, you introduced the concept of Smile Nation, connecting global pioneers through seminars, webinars, and lectures. How does Smile Nation support the development and implementation of new technologies?

Ray places a strong emphasis on the aesthetics aspect while also providing dental treatments rooted in aesthetics. Historically, many dental practitioners relied on analog methods in delivering treatments, resulting in a wide variation in technical capabilities among practitioners. Medical practice and technique typically improve with experience, posing a challenge for less experienced doctors to attain profound capabilities.

However, through digitalization, we can minimize skill gaps among medical practitioners. For instance, dentists used to rely on 2D images for treatments based on their experience. Now, with digital technologies like CT scanners, doctors can provide more sophisticated and intuitive treatments. Achieving this transformation requires training for practitioners. Thus, we offer training not only to Korean practitioners but also to foreign practitioners from Japan, China, Taiwan, and Hong Kong who come to Korea for training sessions. Additionally, we have training centers in the United States and Germany, allowing U.S. practitioners to receive training domestically and Europeans within their continent. The headquarter primarily train Asian practitioners. This approach is highly effective as it enables us to supplement programs that cannot be delivered online. Training and education stand as the essential means through which we can promote and sell our products.

Do you perceive face-driven dentistry as creating a smile within the context of the face, focusing on alignment and symmetry to ensure not only a beautiful smile but also one that harmonizes seamlessly with the overall facial aesthetics? What's your understanding of face-driven dentistry?

Essentially, when we talk about a smile, it involves harmonizing various elements, including symmetry, teeth size, ratio, and the smile line. In the past, dental technicians relied on 2D images and crafted treatments based on their imaginative simulations. However, this approach often resulted in significant disparities between the expected and actual outcomes. Cases emerged where teeth appeared disproportionately larger than the oral size, or excessive gum exposure occurred during a smile. The limitations of treatment solely relying on 2D images were evident. Moreover, all stakeholders—doctors, dental technicians, and patients—had different expectations for the final results.

To address these challenges, we introduced the technology of an avatar or digital twin. This innovation allows all relevant information to be integrated into the system, offering sophisticated images for all stakeholders to examine. AI also suggests the optimal face and dental structure for the patient. Subsequently, the doctor collaborates with the patient, making subtle adjustments based on the AI-suggested image. This refined image is then forwarded to the lab, where technicians manufacture teeth in accordance with the agreed-upon design. This process ensures that every stakeholder is on the same page, a critical aspect of our approach.

Additionally, jaw movement plays a pivotal role. It's not merely about ensuring that upper and lower teeth fit correctly; jaw movement is crucial as our teeth are ultimately meant for chewing and ingesting food. However, with current technology, even if lab technicians create outstanding crowns or other prosthetics, fitting them accurately to the patient's jaw at that moment is challenging due to the inability to fully detect and precisely observe jaw movements. Consequently, patients often undergo lengthy adjustment processes, returning for multiple visits. Although medical schools stress the importance of jaw movements, implementing this knowledge in real-life situations is challenging.

Our technology, which includes CT scans and face scans, compiles data. After the lab technician designs the prosthetics, we conduct a simulation to ensure proper jaw movements virtually. Through this virtual simulation, we place the crown on the patient's teeth. This method proves effective for most patients.

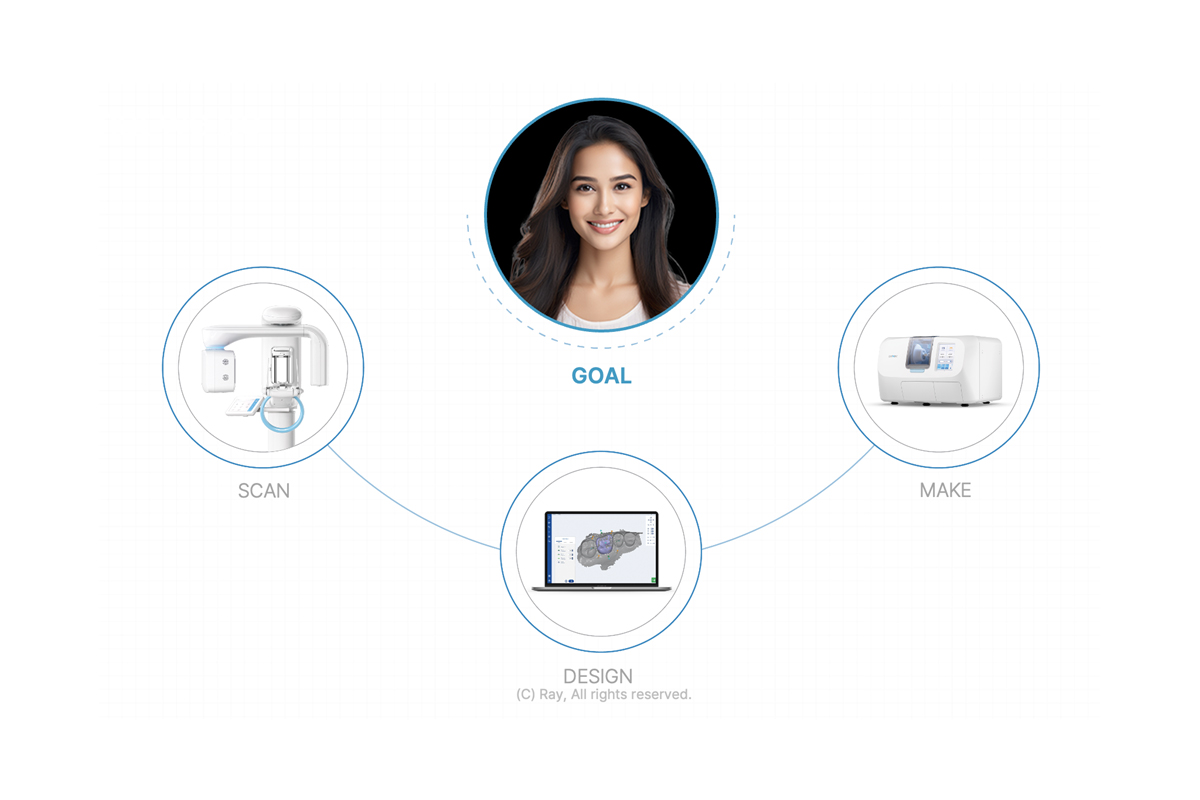

Our ultimate goal is to provide a one-stop solution, enabling patients to complete their entire treatment within an hour of their visit. Traditionally, even for minor treatments, patients would need to make multiple visits—typically two to three times—and for major surgeries, they might need to visit five to 10 times. Our aim is to streamline this process so that patients can receive all necessary scans, get two to three crowns if needed, and be done within an hour. Leveraging our technologies and considering jaw movements, we believe this is achievable. For instance, our milling machine takes only about 20 minutes, and the entire design and consultation can be completed within an hour. This isn't just a one-day solution; it's a one-hour, one-stop solution. By prioritizing the examination of the face before addressing oral components, we confidently assert that our dental technology is futuristic.

How important is the one-day, one-stop concept for your clients?

Firstly, it holds significant importance from the patients' perspective. In today's context, people are generally averse to spending extended periods in hospitals and prefer to avoid multiple visits. From the hospital's standpoint, it is equally crucial. For instance, in procedures like implants, whether a patient visits the hospital once, five times, or ten times, the cost remains fixed. Let's assume it's one million KRW. Irrespective of the number of visits, the implant price remains constant. Hospitals aim to utilize the same amount of time treating more patients rather than treating the same patients multiple times to maximize profitability. Therefore, reducing the time spent on each patient is crucial for the hospital's future beneficiaries.

Additionally, some doctors may seek to enjoy their leisure time. For more intricate surgeries or treatments, doctors often feel immense pressure if prosthetics don't fit after being crafted by the lab technician. Whether it's a misfit or patient complaints, reducing errors and ensuring procedures are completed within an hour, with enhanced accuracy, alleviates the stress on doctors. This is advantageous for all parties involved—the doctors, patients, and lab technicians.

This streamlined process is already in place here. For instance, if you discover a cavity on the second floor right now, you can receive treatment promptly within one or two hours. Our employees actually do this during work hours, and it serves as one of the perks.

The benefit of your technology and devices lies in bringing everything together, making it easy to visualize. Could you share the story of how the concept occurred to you and how you developed the technology to create such a conducive ecosystem of medical devices?

With a Ph.D. in medical engineering, specializing in medical images, my initial interest led to the inception of this company as a specialist in medical images. In the early stages, we had a team of engineers, and our focus was on developing Cone Beam Computed Tomography (CBCT) for the dental sector. Contemplating how this technology could address the specific needs of dental clinics, we expanded our scope to include facial and oral scanners.

In the broader industry, companies often specialize in different technologies—some in milling machines, others in 3D printers, and some in CBCT, design software, and more. However, these technologies are typically provided by separate entities, making it challenging for practitioners to understand and integrate the functionalities of each device. To address this, we made a strategic decision to develop all these devices and simultaneously offer them through a single platform to practitioners. This approach allows for the creation of a chairside solution with just a few clicks. Yet, for this chairside solution to succeed, it must be user-friendly, requiring not only hardware but also comprehensive software. This consideration formed the basis of my development efforts.

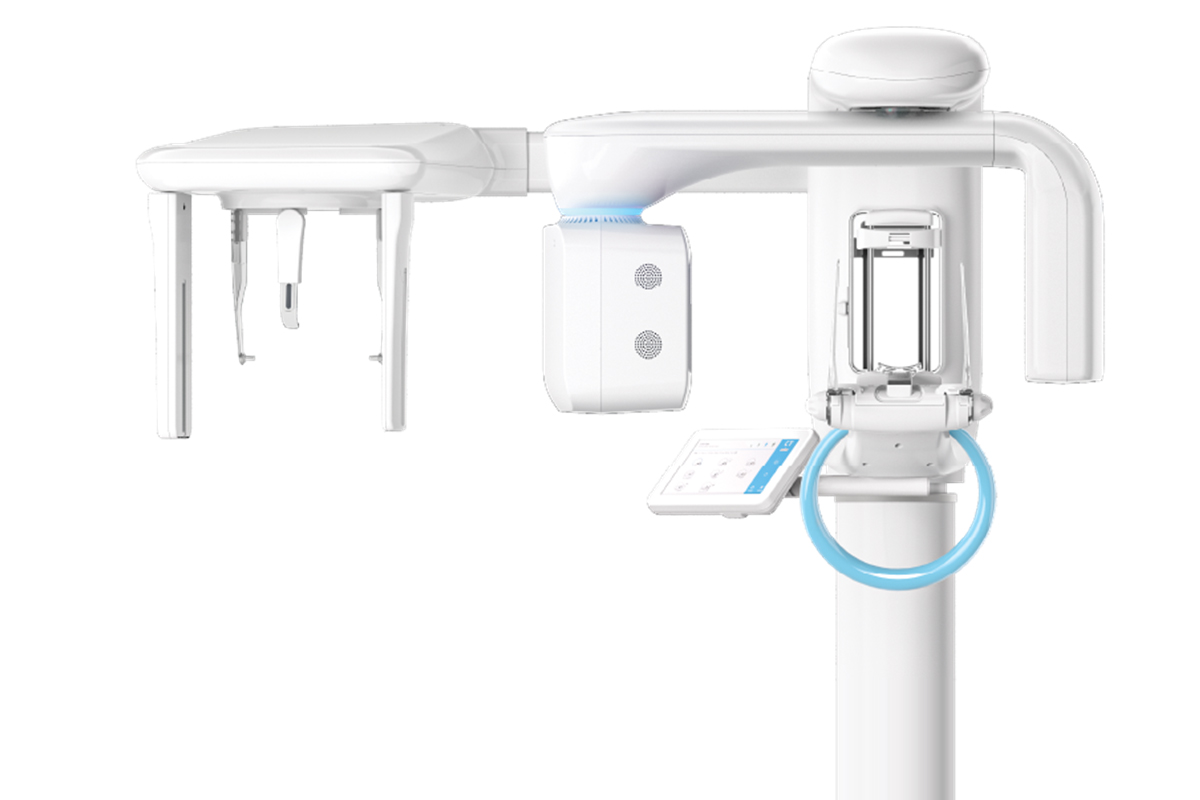

RAY PreMiere – 18x16 FOV 2D/3D Dental X-ray

RAY Mill C - Chairside Grinding Machine

You emphasized the importance of having a comprehensive ecosystem or platform to serve as an end-to-end solution provider. For a dentist in the United States or Europe looking to experience the Ray ecosystem for the first time, how compatible is it? What would you recommend as the initial piece of technology for them to try in order to get a glimpse into the ecosystem?

Addressing your first question regarding compatibility, our platform is designed to be open. We recognized that creating a closed ecosystem, where everyone is restricted to using only our products, would pose challenges in penetrating the market. Hence, we opted for an open platform. By "open," we mean that users can continue using the devices they were accustomed to. However, if they wish to integrate some aspects of our technology, such as CBCT or RAYFace, they have the flexibility to choose, and it is compatible globally. If a clinic opts to use all Ray devices, the experience will be smoother and more seamless. This is precisely what we aim for, as we are confident that once clinics try one of our products, they will likely consider expanding their devices to include more from Ray.

Regarding your second question, I would recommend starting with RAYFace as the initial device. I believe it serves as the foundational aspect of our software. RAYFace is the only facial solution offered by any company worldwide, making it unique. By beginning with RAYFace, clinics can then expand their use to include other devices such as oral scanners, CBCT, and more.

Digitalization is erasing the boundaries between industries. In this context, it's fascinating to see how digitalization is merging the realms of health and aesthetics into one cohesive entity. When we consider teeth, we not only look at healthy habits and jaw movements, but also RAYFace allows aesthetics to be reflected for the patient. Looking ahead to the future and the expanding applications of technology across industries, where the lines between dentistry, aesthetics, and more are likely to blur, how do you envision the future use of your technology in other fields such as medicine and aesthetics? How do you see Ray evolving beyond its current industry?

We are currently venturing into the beauty, aesthetics, and plastic surgery industries, aiming to apply our devices for those purposes. Recently, we initiated a collaboration with Asan Medical Center. They approached us with a request for software designed not only for dental solutions but also for plastic surgery. Leveraging our own devices for scanning and accumulating face data, we expanded into the domains of aesthetics and plastic surgery. Consequently, we developed new software and released a beta version of it. Just last week, at the world's largest medical exhibition, Medica, held in Germany, we participated for the first time and showcased this software.

Let me provide an overview of this new software. Essentially, after capturing an image and performing a CT scan of the face, the software utilizes AI to identify symmetrical points on the face. In a plastic surgery clinic, specific ratios are crucial, and symmetry holds paramount importance. The software automatically detects these ratios and optimal angles of facial features, presenting them through 3D rendering. It identifies over 200 significant points on the face, considering various information on length, ratio, and angles. This allows the doctor and patient to make virtual adjustments. Moreover, the software enables simulations, offering clear before-and-after images. Patients can visualize the potential outcomes after procedures like applying 0.5cc of Botox or fillers in specific areas or undergoing plastic surgery. It provides a 3D simulation of the effects of surgical procedures. Our plan is to obtain all necessary approvals and authorizations early next year, with the aim of releasing it to the market by the end of the next year.

RAYFace - 3D Facial Scanner

What are your expectations for Ray, particularly RAYFace, in terms of international expansion in the coming years? How do you anticipate this specific product benefiting practitioners, doctors, and dentists in both Europe and the U.S.?

We are actively pursuing the EU market and have already made inroads into several European dental markets, including Germany, France, and the Netherlands. Our primary focus is on top-tier implant surgeons, and we're pleased to note that RAYFace devices are gaining traction among this group. Through positive word of mouth, RAYFace is generating significant interest among top-tier implant surgeons in both Europe and the U.S.

Looking at our company's revenue structure, a substantial 90% is derived from overseas markets, underscoring the importance of our international presence. We also have more employees overseas than in Korea, with established branches for conducting business activities. As for our software designed for plastic surgery purposes, it is currently in the final stages, and we plan to actively promote it starting next year.

Your products have three benefits—increased profits for dentists, reduced chair time for a more comfortable patient experience, and improved follow-up to align expectations with reality. In essence, it's better, faster, and cheaper. Yet, why isn't this technology more widely adopted globally, especially in the U.S. and European markets? What do you see as the primary obstacles hindering the widespread use of your technology or similar types of technology?

As mentioned earlier, many surgeons exhibit a conservative approach when it comes to changing their devices, presenting a significant barrier. Throughout this interview, we've emphasized the need for our devices to be more profitable and user-friendly to overcome this conservatism. While we don't anticipate an explosive growth in the adoption of our medical devices, we aim for gradual and incremental market share gains, similar to how implants gained prominence in Korea over time. We are patiently waiting for the right moment and preparing for it. The timeline is uncertain, whether it be next year or five years later. What's promising is that some top-level doctors and early adopters are swiftly incorporating our devices into their practices. These competent surgeons, not only in the U.S. and EU but also in countries like Thailand and other Southeast Asian nations, are already using our devices. While they may be a minority, they serve as influential opinion leaders in the industry. Through positive word of mouth and their endorsement, we believe we can exponentially increase our market share.

For more details, explore their website at https://www.raymedical.com/en

0 COMMENTS